1 What Is Title Insurance And Do I Need It?

- Author: forbes.com

- Published Date: 02/14/2022

- Review: 4.97 (975 vote)

- Summary: · Who Pays For Title Insurance? The buyer pays for the lender’s title insurance policy as part of their closing costs. Either the buyer or seller

- Matching search results: Let’s say you lose your home because it turns out the property was sold to you fraudulently. You’re not going to keep paying the mortgage. The lender will then file a claim with its title insurance company to recoup the mortgage payments it was …

- Source: 🔗

2 Buyer or Seller: Who Pays for Closing Costs and Title Insurance?

- Author: bntc.com

- Published Date: 09/16/2022

- Review: 4.66 (285 vote)

- Summary: · The home buyer’s escrow funds end up paying for both the home owner’s and lender’s policies. Upon closing, the cost of the home owner’s title

- Matching search results: Fees can be negotiable, and it’s important to keep in mind that you can shop lenders until you find one that offers you a loan with lower fees. Closing costs may vary depending on where you live, the type of property you buy, as well as the type of …

- Source: 🔗

3 Who Pays for Title Insurance or The Policy in Texas?

- Author: nationaltitlegroup.com

- Published Date: 02/24/2022

- Review: 4.53 (538 vote)

- Summary: · If you are wondering who pays owner’s title insurance, it is the home buyer who places their money into the home buyer’s escrow funds

- Matching search results: In most cases, the party that pays for the title policy can choose the title company provider. Since the buyer benefits from the type of title policy they receive, even if the seller pays for it, the buyer has the power to demand that their title …

- Source: 🔗

4 Who Pays For Title Insurance? | Landtrust Title Services

- Author: mylandtrust.com

- Published Date: 07/18/2022

- Review: 4.29 (524 vote)

- Summary: · An owner’s policy is generally issued for the full purchase price of the property, and obligates the insurer to protect the owner’s title

- Matching search results: In Illinois and Wisconsin, the buyer typically pays the lender’s title insurance premium as part of the buyer’s closing costs. The premium is a one-time cost, and the policy protects against claims that existed but were not known to the parties at …

- Source: 🔗

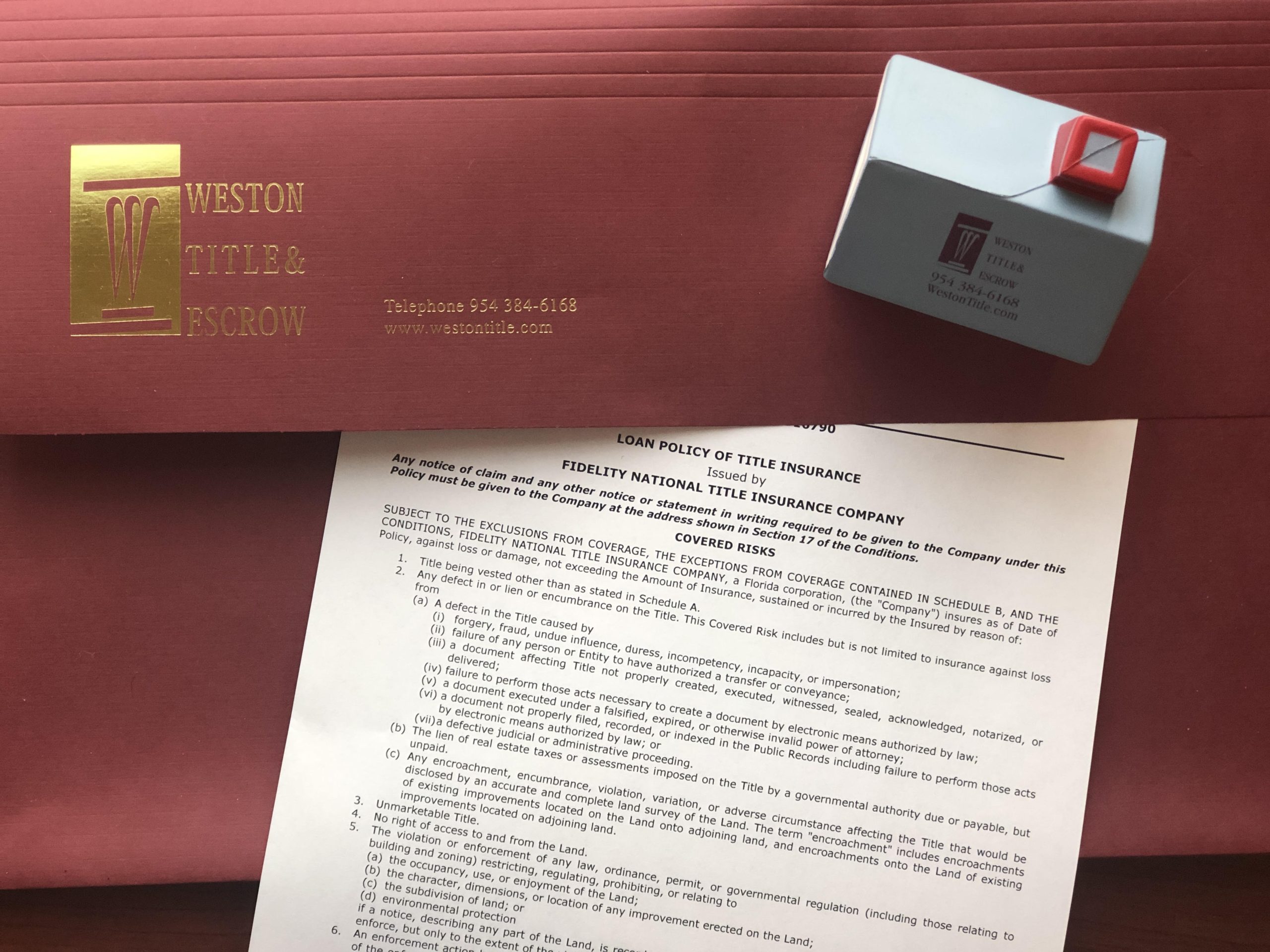

5 Who Pays for Title Insurance in Florida?

- Author: westontitle.com

- Published Date: 07/23/2022

- Review: 4.06 (510 vote)

- Summary: It can be only two parties: the buyer or the seller. In very rare circumstances, it can be negotiated in such a way that both parties pay, but that is highly,

- Matching search results: Real estate can be fairly complicated, affecting the rights of many people who may have a legal claim to a particular piece of property. Forgery, wills, fraud, mental incompetence, marriage and divorce, minors entering into contracts, and mistakes …

- Source: 🔗

6 Who Pays Title Insurance Costs in Washington, Buyer or Seller?

- Author: sammamishmortgage.com

- Published Date: 02/15/2022

- Review: 3.82 (258 vote)

- Summary: Title insurance is a unique type of insurance that protects homeowners and lenders from

- Matching search results: So, who pays for title insurance in Washington State – the buyer or seller? While this can vary from one transaction to the next, it’s customary for the seller to pay for the buyer’s owner policy, and the buyer typically pays for the mortgage …

- Source: 🔗

7 Who Pays for the Title Insurance?

- Author: simpleshowing.com

- Published Date: 01/16/2022

- Review: 3.61 (239 vote)

- Summary: · The actual law that decides who has to pay for the title insurance differs from state-to-state and can even change from one county to another

- Matching search results: Furthermore, it’s never a good idea for the buyer to go to the same title insurance company that the seller used back when they purchased the property. It’s unlikely the same company will find anything different, which could be a big problem later …

- Source: 🔗

8 What Is Title Insurance and How Does it Work?

- Author: time.com

- Published Date: 08/31/2022

- Review: 3.39 (460 vote)

- Summary: · If you were to ever refinance your home, you’ll have to purchase a new lender’s title insurance policy but you don’t have to pay for owner’s

- Matching search results: “Without that optional title insurance in place, for example, you could either be forced to pay a judgment to have a lien released or have to hire an attorney to sue your seller. That’s just one risk of many that we frankly don’t know when we’re …

- Source: 🔗

9 Who Pays Lenders Title Insurance

- Author: mathistitle.com

- Published Date: 05/17/2022

- Review: 3.35 (561 vote)

- Summary: · In many cases, the buyer of a home pays for the lender’s title insurance policy, and vice-versa. However, this may vary depending on the

- Matching search results: Unlike other types of insurance policies, title insurance is paid once at closing rather than on a monthly, semi-annual, or annual basis. It’s important to buy title insurance immediately after closing because without this form of protection, issues …

- Source: 🔗

10 Title insurance FAQ – Texas Department of Insurance

- Author: tdi.texas.gov

- Published Date: 09/09/2022

- Review: 3.11 (484 vote)

- Summary: · The title company will defend you in court if there is a claim against your property, and will pay for covered losses

- Matching search results: The title commitment comes before closing; the title policy is issued after closing. The commitment says that a title company is willing to issue title insurance under certain conditions and if the seller fixes certain problems. The policy provides …

- Source: 🔗

11 Who Pays for Closing Costs and Title Insurance?

- Author: spruce.co

- Published Date: 06/30/2022

- Review: 2.94 (127 vote)

- Summary: · Who pays for the owner’s title insurance policy can depend a lot on local customs in your state (or even the region in your state) and the

- Matching search results: Who pays for the owner’s title insurance policy can depend a lot on local customs in your state (or even the region in your state) and the current housing market, so having the seller cover this cost isn’t guaranteed, but it happens more often than …

- Source: 🔗

12 Title Insurance – Minnesota.gov

- Author: mn.gov

- Published Date: 03/20/2022

- Review: 2.87 (137 vote)

- Summary: Either a home seller or home buyer may buy an owner’s policy. In many areas, sellers pay for owner title policies as part of their obligation in the transfer of

- Matching search results: Although home buyers are free to shop around for a title agent or a title insurer, many home buyers do not. Because buyers are unfamiliar with title insurance, they tend to let lenders and/or real estate professionals who are parties to the home …

- Source: 🔗

13 Who Pays Title Insurance Costs in California – Buyer or Seller?

- Author: jvmlending.com

- Published Date: 04/11/2022

- Review: 2.73 (171 vote)

- Summary: · The owner’s policy is paid for by the buyer and is usually optional. In most cases, the cost of the owner’s title insurance policy is paid only

- Matching search results: Title insurance is required for nearly all mortgage loans in California. This special type of insurance carries a one-time cost and acts as a critical safeguard for homebuyers against “title claims” – such as undisclosed debt associated with the …

- Source: 🔗

14 Title-Insurance – California Department of Insurance

- Author: insurance.ca.gov

- Published Date: 03/27/2022

- Review: 2.59 (112 vote)

- Summary: In almost every county, the buyer pays the lender’s policy premium. The parties are free to negotiate a different allocation of fees. Your title company or

- Matching search results: It has been the practice in Northern California that the buyer customarily pays the premium for title insurance, or occasionally the premium is split between buyer and seller. In almost every county, the buyer pays the lender’s policy premium. The …

- Source: 🔗