1 Self-Funded vs. Fully-Insured: Weighing the Cost Savings for Your Business

- Author: onedigital.com

- Published Date: 01/21/2022

- Review: 4.81 (745 vote)

- Summary: · In a nutshell, self-funding one’s health plan, as the name suggests, involves paying the health claims of the employees as they occur. With a

- Matching search results: I always recommend small employers purchase two types of stop loss coverage. Individual or specific stop-loss provides coverage for each individual on the plan. Aggregate stop-loss covers the total annual cost of the health plan. With individual …

- Source: 🔗

2 Top 4 Reasons Employers Are Switching To Self Funding Insurance

- Author: bbgbroker.com

- Published Date: 06/15/2022

- Review: 4.61 (344 vote)

- Summary: · Self funding, otherwise known as self-insured insurance, is a plan in which the employer takes on the financial risk of providing certain

- Matching search results: Self funding, otherwise known as self-insured insurance, is a plan in which the employer takes on the financial risk of providing certain healthcare benefits to his or her employees. With self funding insurance, companies pay for healthcare expenses …

- Source: 🔗

3 Self-Funded (Self-Insured) Association Health Plans

- Author: associationhealthplans.com

- Published Date: 05/22/2022

- Review: 4.52 (574 vote)

- Summary: Self-funded health plans, otherwise known as self-insured health plans, are health plans where the financial risk associated with medical claims is held by

- Matching search results: To protect the health plan against catastrophic medical claims, a self-funded association health plan can obtain “stop loss” coverage. Also known as “excess insurance,” stop loss insurance is a policy covering medical claims that exceed a …

- Source: 🔗

4 Self-funded health insurance pros and cons

- Author: sanabenefits.com

- Published Date: 11/03/2021

- Review: 4.32 (575 vote)

- Summary: · Kaiser Family Foundation (KFF) defines a self-funded plan as “An insurance arrangement in which the employer assumes direct financial

- Matching search results: Employers only pay for the healthcare that employees use. When a considerable number of claims or expensive claims arise, the stop-loss insurance mentioned above kicks in (if the plan is level-funded). You can manage your claims directly, avoiding …

- Source: 🔗

5 Self-funded insurance FAQs: Answers you need to make the shift

- Author: healthgram.com

- Published Date: 06/13/2022

- Review: 4.16 (238 vote)

- Summary: Q: What is self-funded insurance? … A: Instead of paying premiums to traditional health insurance companies, many employers opt to accept responsibility for

- Matching search results: A: Self-funding is an option for mid-size and large companies across industries. The number of self-funded companies is steadily rising: 61% of covered employees in the US are covered by a self-funded plan, while 81% of all firms with more than 200 …

- Source: 🔗

6 Consumer Alert: Beware of the Risks in Self-Funded Health Plans

- Author: mass.gov

- Published Date: 12/22/2021

- Review: 3.89 (331 vote)

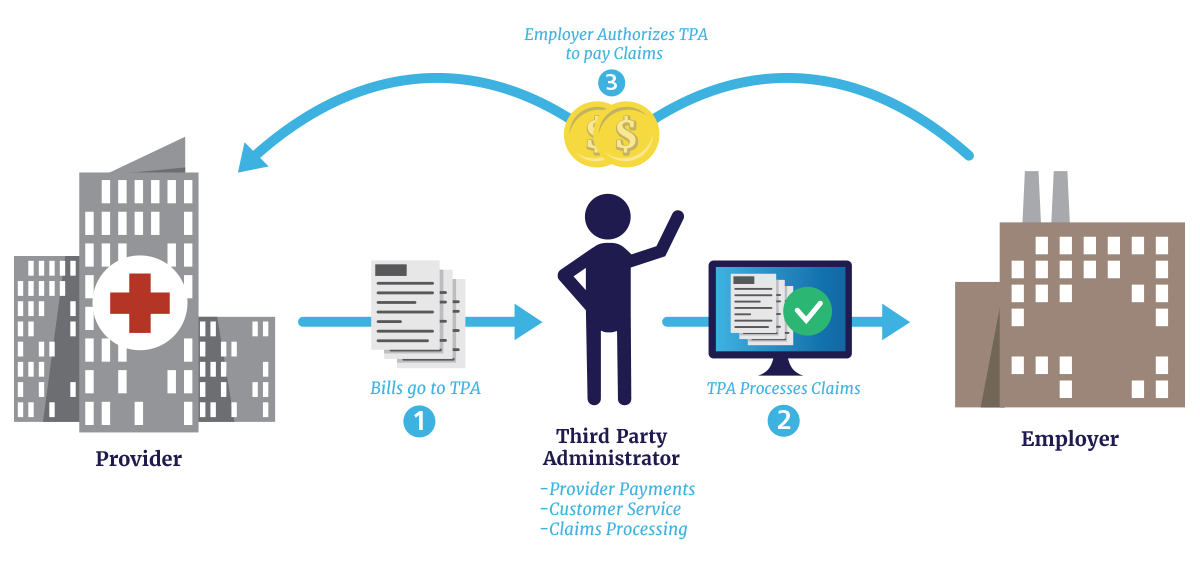

- Summary: In a self-funded health plan, an employer funds the cost of all health services covered by the health plan. Although many employers hire an administrator to

- Matching search results: Employers who set up self-funded health plans are responsible for payment of all covered health claims, whether routine or catastrophic. Employers may buy so-called “stop loss” insurance to help cover high-cost claims, but employers are responsible …

- Source: 🔗

7 Self-Funding 101 – ASR Health Benefits

- Author: asrhealthbenefits.com

- Published Date: 06/29/2022

- Review: 3.79 (401 vote)

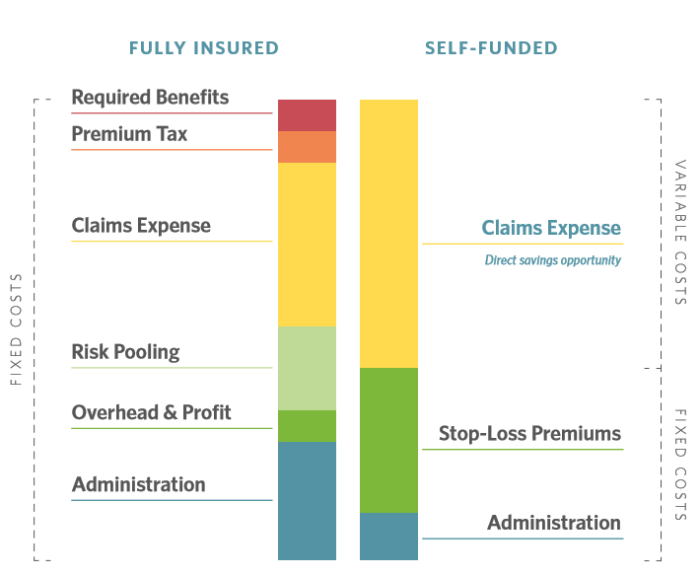

- Summary: Is Self-Funding Right For Your Company? … In contrast to a fully insured plan where the cost is the total of all premiums paid, the cost of a self-funded plan

- Matching search results: The flexibility of self-funding helps employers use their health benefit plans the way they were originally intended – to attract and retain the finest employees. Benefits can be customized to meet your employees’needs and to satisfy company …

- Source: 🔗

8 The Pros and Cons of Self-Funded Health Plans

- Author: blog.ifebp.org

- Published Date: 10/24/2021

- Review: 3.56 (456 vote)

- Summary: · Advantages of a Self-Funded Health Plan · There is more flexibility in customizing the plan to the employer’s goals and the employee population

- Matching search results: Employers providing health care benefits to their employees can choose one of two options: a fully insured health plan or a self-funded health plan. Although there are many similarities between the two, there are striking differences as well—And …

- Source: 🔗

9 A self-funded plan can be part of your strategy to lower health care costs

- Author: aetna.com

- Published Date: 03/15/2022

- Review: 3.27 (224 vote)

- Summary: Infographic Transcript: Is self-insurance right for you? Self-insurance is also called a self-funded plan. This is a type of plan in which an employer takes on

- Matching search results: Employers providing health care benefits to their employees can choose one of two options: a fully insured health plan or a self-funded health plan. Although there are many similarities between the two, there are striking differences as well—And …

- Source: 🔗

10 What are Self-Funded Health Plans?

- Author: varipro.com

- Published Date: 11/05/2021

- Review: 3.04 (355 vote)

- Summary: Self-funded health plans are a strategy where an employer pays employee health claims directly to providers, rather than through an insurance company

- Matching search results: A: Federal regulations require TPA’s to track and provide reports to clients. These company-specific reports are updated regularly and contain actionable information that can identify cost savings, guide plan customization and wellness strategy of …

- Source: 🔗