1 How Do I Create a Bond for Auto Insurance?

- Author: thedetroitbureau.com

- Published Date: 05/03/2022

- Review: 4.8 (889 vote)

- Summary: · The SR-22 surety bond is typically a three-party agreement between the state, the driver – and the insurance company that agrees to provide the

- Matching search results: Drivers often believe that all is lost if their auto insurance application is denied because they’re deemed to be high-risk motorists. While it’s true that auto insurance is necessary for most states, there is still an option available for high-risk …

- Source: 🔗

2 Surety Bonds vs. Insurance Policy

- Author: performancesuretybonds.com

- Published Date: 07/26/2022

- Review: 4.68 (513 vote)

- Summary: · Risk management: Risk or liability management is approached differently in insurance vs surety bonds. An insurance company anticipates losses,

- Matching search results: An applicant’s credit history also has a big impact on bond price. People with strong credit scores and business financials are considered lower risk and, in turn, pay lower premiums. While individuals with poor credit may pay a higher premium. To …

- Source: 🔗

3 Car Insurance Alternatives: What You Should Know

- Author: caranddriver.com

- Published Date: 03/01/2022

- Review: 4.43 (308 vote)

- Summary: · A surety bond requires the holder to pay a specific amount of money. The fund will cover the driver’s expenses in an accident equal to its value

- Matching search results: Car insurance alternatives make sense for people who can’t afford the high cost of auto insurance. While most states require drivers to buy insurance, it might be possible to use other means of protection. This article discusses alternatives to car …

- Source: 🔗

4 Can a Surety Bond Replace Actual Car Insurance?

- Author: insurancepanda.com

- Published Date: 11/01/2021

- Review: 4.26 (210 vote)

- Summary: · How Does a Surety Bond Work for Claims? … A surety bond is an alternative to auto insurance, but it functions differently from auto insurance

- Matching search results: Some people use surety bonds to save money. Surety bonds have a lower upfront cost, although the total costs may be much higher than auto insurance. With a surety bond, you pay lower premiums today, but you may lose the entire value of the bond in …

- Source: 🔗

5 Insurance companies who offer dealer bonds

- Author: wisconsindot.gov

- Published Date: 12/08/2021

- Review: 4.08 (461 vote)

- Summary: If you have questions regarding surety bonds with your personal insurance carrier please contact them directly. … Auto Owners Insurance Company

- Matching search results: Some people use surety bonds to save money. Surety bonds have a lower upfront cost, although the total costs may be much higher than auto insurance. With a surety bond, you pay lower premiums today, but you may lose the entire value of the bond in …

- Source: 🔗

6 What is a surety bond? – UFG Insurance

- Author: ufginsurance.com

- Published Date: 04/25/2022

- Review: 3.87 (489 vote)

- Summary: · The surety, otherwise known as the insurance company providing the bond, guarantees to the obligee that the principal will fulfill an obligation

- Matching search results: “They call me bond, surety bond.” It may sound like the latest Hollywood blockbuster, but there’s no villain, secret lairs or European sports cars here — we’re talking surety bonds. More specifically, what is a surety bond, and how can it help …

- Source: 🔗

7 How do I create a bond for auto insurance?

- Author: autoinsurance.org

- Published Date: 04/24/2022

- Review: 3.6 (424 vote)

- Summary: · Typically, the courts will order a driver to get a surety bond after one or more serious driving-related incidents. For example, if authorities

- Matching search results: If you wish to pursue an SR-22 bond, you will not create one for yourself. Instead, your auto insurance or a third-party company will authorize a bond on your behalf. Car insurance bonds and auto insurance laws vary state by state, so the process …

- Source: 🔗

8 Surety Bonds as an Alternative to Auto Insurance

- Author: autoinsuresavings.org

- Published Date: 03/20/2022

- Review: 3.43 (228 vote)

- Summary: · Surety bonds are cheaper upfront, but the long term costs can far exceed auto insurance premiums. The presence of coverage among legal drivers

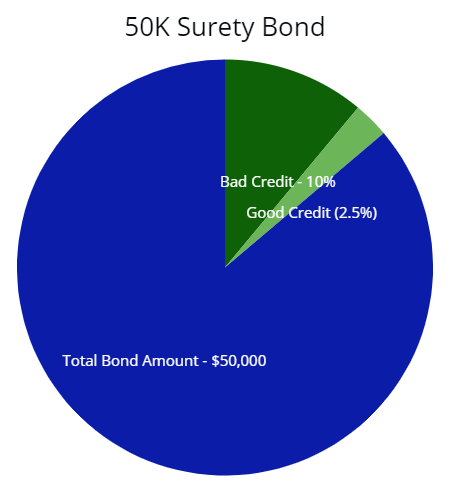

- Matching search results: Note: For a 50,000 surety bond, a person with good credit can pay a 1% to 2.5% premium for the bond’s costs or about $1,250. And those with bad credit can pay 10% or more in this example, about $5,000. This is for illustrative purposes only, and …

- Source: 🔗

9 Alternatives to Car Insurance: Surety Bonds

- Author: carinsurancecomparison.com

- Published Date: 01/30/2022

- Review: 3.31 (542 vote)

- Summary: · A surety bond is similar to a car insurance policy. It protects against loss due to theft, fire, vandalism, etc. There are several different

- Matching search results: In a number of states, surety auto insurance bonds are not available. Instead, individuals must rely on ordinary insurance or pay the Department of Motor Vehicles a cash deposit. However, a business owner would be in the position to take full …

- Source: 🔗

10 How many people in California post a Surety Bond for Car Insurance

- Author: swiftbonds.com

- Published Date: 05/22/2022

- Review: 3.14 (505 vote)

- Summary: One way is to purchase a self-insurance bond which requires setting aside $15 thousand dollars as adequate coverage for an accident occurrence in California

- Matching search results: Most states, including CA, require motorists to have Liability Insurance. This is used to pay for damage and injuries that someone else incurs in an accident that’s your fault. The law does not require motorist’s liability insurance protects …

- Source: 🔗