1 6 California SR-22 Filing FAQs – Call us for an immediate SR-22 quote 619-276-0492

- Author: mccormickinsure.com

- Published Date: 02/03/2022

- Review: 4.93 (886 vote)

- Summary: · What is an SR-22 filing? It is a digital link from your California auto insurance carrier to the DMV that lets the DMV know if you are

- Matching search results: Once your insurance policy expires or cancels, for whatever reason, your insurance company is required to notify the DMV immediately. Typically they will suspend your drivers license within a few days to a couple of weeks depending on how fast your …

- Source: 🔗

2 All You Need to Know About SR-22 Insurance in California

- Author: sr22adviser.com

- Published Date: 06/07/2022

- Review: 4.7 (419 vote)

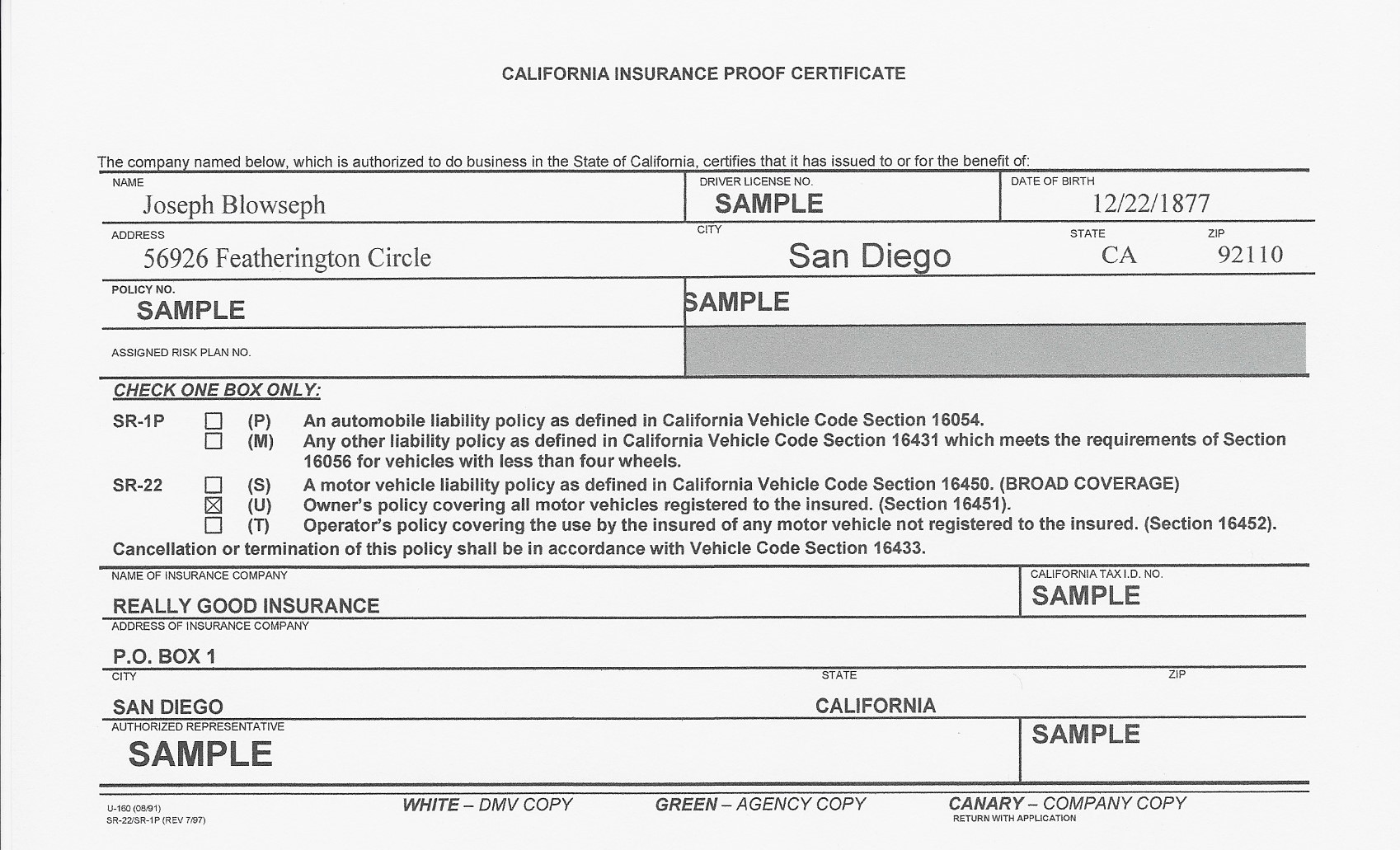

- Summary: Rather, an SR-22 is a form filled out by your insurance company that guarantees you are carrying continuous insurance at the minimum coverage levels. An SR-22

- Matching search results: If the state of California has suspended or revoked your license, there are steps you can take to restore your driving privileges — sometimes more quickly than expected. The most important step once you’re allowed to drive again is getting high-risk …

- Source: 🔗

3 Secrets of SR-22 Insurance – San Diego DUI Lawyer

- Author: sandiegoduilawyer.com

- Published Date: 04/14/2022

- Review: 4.46 (367 vote)

- Summary: An SR-22 is (normally electronic) notification by an insurance company to DMV you have auto liability insurance in effect which satisfies California’s

- Matching search results: Even though your SR-22 can be filed electronically, you should be able to get an original from your insurance company and hand-deliver it to any California DMV field office so you are not delayed by the state clerks in Sacramento to do their job …

- Source: 🔗

4 Best Cheap SR-22 Insurance Rates in California

- Author: valuepenguin.com

- Published Date: 07/26/2022

- Review: 4.28 (261 vote)

- Summary: · SR-22 insurance is often referred to as DUI insurance, as you’ll likely be required to file an SR-22 in order to reinstate your driving

- Matching search results: If you’re convicted of a DUI or other violation and have your license suspended, you will need to maintain liability insurance and file an SR-22 form for the stated amount of time in order to reinstate your driving privileges. Even if you don’t own …

- Source: 🔗

5 SR22 California – What is it? When do I need it? How do I get one?

- Author: shouselaw.com

- Published Date: 01/11/2022

- Review: 4.02 (238 vote)

- Summary: Simply put, a California SR22 is a form (provided by your car insurance company) that verifies you have met this state’s requirement with respect to auto

- Matching search results: Fortunately, a DUI isn’t the only factor that car insurance companies consider before they make decisions about whether to raise your rates. Most companies will also look at your driving history, your age and driving experience, your marital status, …

- Source: 🔗

6 Average Costs of SR-22 Insurance in California

- Author: freewayinsurance.com

- Published Date: 11/17/2021

- Review: 3.98 (512 vote)

- Summary: An SR-22 is actually a guarantee that the insurance company makes to the state of California. By sending an SR-22, the insurer guarantees that your policy meets

- Matching search results: Non-owner insurance only applies if you do not have access to a car within your household. For instance, if your roommate has a car, a non-owner policy may not be available. Instead, you might need to be listed on your roommate’s car insurance, and …

- Source: 🔗

7 SR-22 in California | Bankrate

- Author: bankrate.com

- Published Date: 01/14/2022

- Review: 3.65 (597 vote)

- Summary: · An SR-22 is a type of form filed with the Department of Motor Vehicles (DMV) to show that a driver has an auto insurance policy in force

- Matching search results: If your driving privileges were revoked after a major violation, you’d need to prove that you have insurance to reinstate your license. An SR-22 requirement means that your insurance company will need to file the SR-22 form with the DMV as proof of …

- Source: 🔗

8 California SR-22 Insurance with Cheap Rates $10/month

- Author: mis-insurance.com

- Published Date: 12/05/2021

- Review: 3.45 (260 vote)

- Summary: In California, the average cost of SR-22 rates is $1,592 a year. MIS-Insurance offers cheap SR22 insurance (As low as $10/month) that will save you money over

- Matching search results: Remember that throughout the duration of your SR-22 filing, your auto insurance rates will be increased. Also, you will no longer need to file an SR-22 form once you maintain a clean driving record and if you keep it for the required duration. That …

- Source: 🔗

9 California SR-22 Insurance: What It Is and How Much It Costs

- Author: moneygeek.com

- Published Date: 09/30/2021

- Review: 3.34 (523 vote)

- Summary: · Minimum coverage SR-22 insurance in California costs about $1,857 per year on average when an SR-22 form was filed due to a DUI. In contrast, a

- Matching search results: SR-22 insurance is more expensive than a typical policy, primarily because of the severity of the violation. While the SR-22 form itself typically costs only a small fee, associated offenses like a DUI can have a significant impact on your auto …

- Source: 🔗