1 What are Self-Funded Health Plans?

- Author: varipro.com

- Published Date: 04/17/2022

- Review: 4.83 (672 vote)

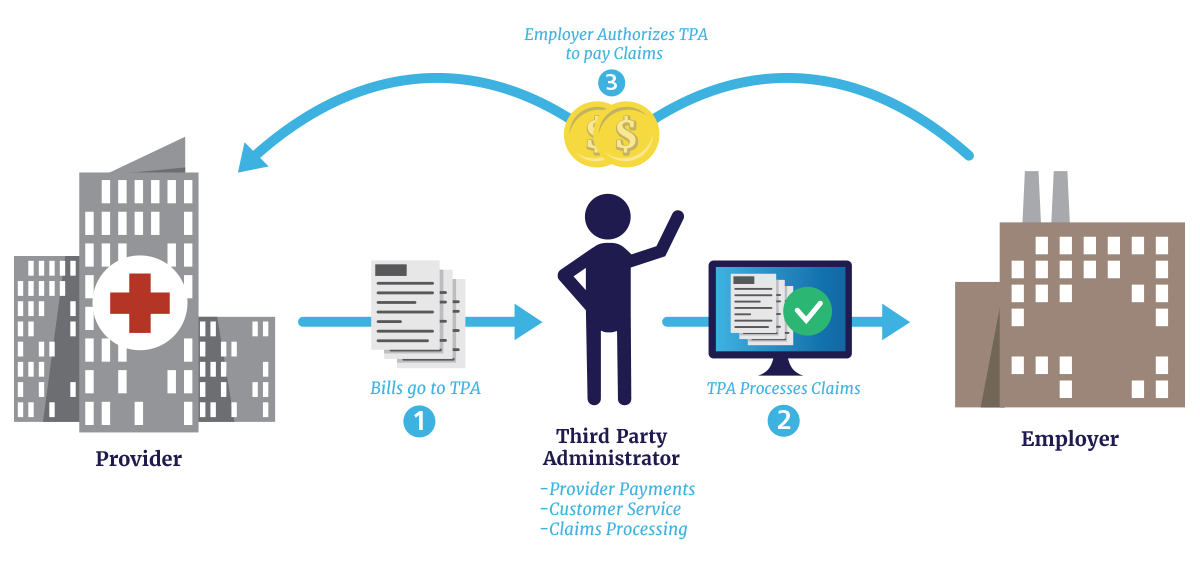

- Summary: In basic terms, self-funded health benefit plans (also referred to as self-insured and self-funding) are a health plan strategy where an employer pays member

- Matching search results: In basic terms, self-funded health benefit plans (also referred to as self-insured and self-funding) are a health plan strategy where an employer pays member health claims directly to health providers, rather than paying premiums to a health …

- Source: 🔗

2 Self-Funded vs. Fully-Insured: Weighing the Cost Savings for Your Business

- Author: onedigital.com

- Published Date: 08/31/2022

- Review: 4.69 (589 vote)

- Summary: · In a nutshell, self-funding one’s health plan, as the name suggests, involves paying the health claims of the employees as they occur. With a

- Matching search results: So why wouldn’t an employer self-fund? There are some employers for whom a fully-insured plan is still the best way to go. Employers without the time or resources to devote to a more hands-on, complex plan should probably stay with a simpler plan …

- Source: 🔗

3 Self-Funded (Self-Insured) Association Health Plans

- Author: associationhealthplans.com

- Published Date: 12/08/2021

- Review: 4.43 (500 vote)

- Summary: Self-funded health plans, otherwise known as self-insured health plans, are health plans where the financial risk associated with medical claims is held by

- Matching search results: A self-funded association health plan may employ a trust to hold monies designated for the health plan. The trust separates health plan funds from other association operation funds and can protect them from creditor claims. It may also allow income …

- Source: 🔗

4 Moving To Self-Funded Health Plan Guide

- Author: phiagroup.com

- Published Date: 03/13/2022

- Review: 4.29 (234 vote)

- Summary: Both fully insured and self-funded health plans operate under the same basic principle. Money is collected and used to pay for medical expenses of the insured

- Matching search results: Under the Employee Retirement Income Security Act of 1974 (“ERISA”), private self-funded benefit plans are exempt from State insurance laws. In other words, these plans must comply with Federal law, but can avoid compliance with many burdensome …

- Source: 🔗

5 A self-funded plan can be part of your strategy to lower health care costs

- Author: aetna.com

- Published Date: 03/12/2022

- Review: 4.13 (517 vote)

- Summary: Self-funded plans may be more flexible than traditional, fully-insured plans. They’re subject to less regulation and offer business the opportunity to

- Matching search results: Under the Employee Retirement Income Security Act of 1974 (“ERISA”), private self-funded benefit plans are exempt from State insurance laws. In other words, these plans must comply with Federal law, but can avoid compliance with many burdensome …

- Source: 🔗

6 Self-Funding 101 – ASR Health Benefits

- Author: asrhealthbenefits.com

- Published Date: 08/27/2022

- Review: 3.87 (490 vote)

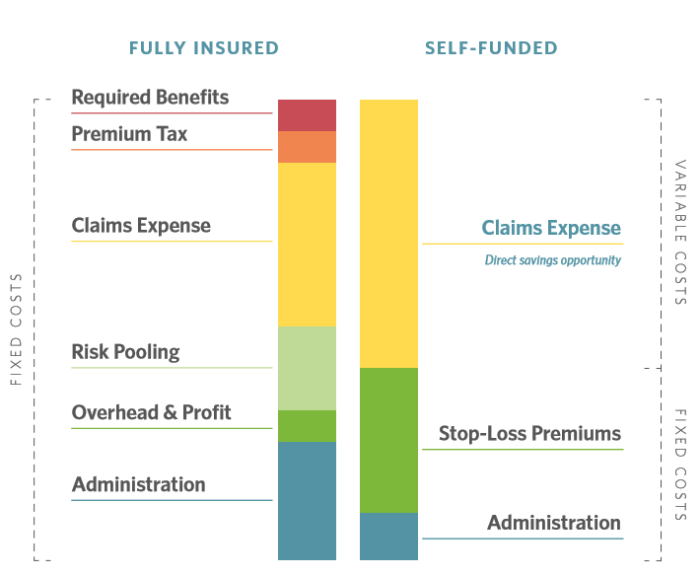

- Summary: In contrast to a fully insured plan where the cost is the total of all premiums paid, the cost of a self-funded plan is the total of administrative expenses,

- Matching search results: In contrast to a fully insured plan where the cost is the total of all premiums paid, the cost of a self-funded plan is the total of administrative expenses, stop-loss premiums, and the claims that will be paid by the plan less stop-loss insurance …

- Source: 🔗

7 Consumer Alert: Beware of the Risks in Self-Funded Health Plans

- Author: mass.gov

- Published Date: 10/10/2021

- Review: 3.71 (429 vote)

- Summary: In a self-funded health plan, an employer funds the cost of all health services covered by the health plan. Although many employers hire an administrator to

- Matching search results: Employers must be aware of federal non-discrimination rules applying to employer-sponsored health plans. Health factors – including current or future health conditions – may not be used to deny access to the employer-offered health coverage, …

- Source: 🔗

8 Self Funded Health Insurance

- Author: myknowledgebroker.com

- Published Date: 12/22/2021

- Review: 3.58 (297 vote)

- Summary: Self Funded Health Plan Overview · Self funding treats predictable claim costs as expenses rather than as insurable risk items. · In a self funded plan model, we

- Matching search results: The only way to know if your organization can benefit from self funding is to analyze your existing plan design and recent claims experience. Advantages of Self Funding Health Insurance. R&R Insurance provides this analysis at no cost or …

- Source: 🔗

9 Self-Funded, Non-Federal Governmental Plans – CMS

- Author: cms.gov

- Published Date: 11/15/2021

- Review: 3.26 (433 vote)

- Summary: The information in this section will be of interest to state and local governmental employers that provide self-funded group health plan coverage to their

- Matching search results: Prior to enactment of the Affordable Care Act, sponsors of self-funded, non-Federal governmental plans were permitted to elect to exempt those plans from, or “opt out of,” certain provisions of the Public Health Service (PHS) Act. This election was …

- Source: 🔗

10 Self-funded insurance FAQs: Answers you need to make the shift

- Author: healthgram.com

- Published Date: 02/12/2022

- Review: 3.13 (399 vote)

- Summary: In a self-funded model, employers purchase stop-loss insurance to protect against the financial risk of catastrophic claims. This coverage reimburses or even

- Matching search results: A: Self-funding is an option for mid-size and large companies across industries. The number of self-funded companies is steadily rising: 61% of covered employees in the US are covered by a self-funded plan, while 81% of all firms with more than 200 …

- Source: 🔗