Are you interested in the new Marriott Bonvoy credit cards? With the recent revamp of the Marriott Bonvoy card range, it’s important to understand the specific terms and conditions before applying. In this article, we’ll provide an overview of the Marriott Bonvoy portfolio, including the sign-up bonuses and benefits of each card. Let’s go!

Introducing Marriott Bonvoy Cards

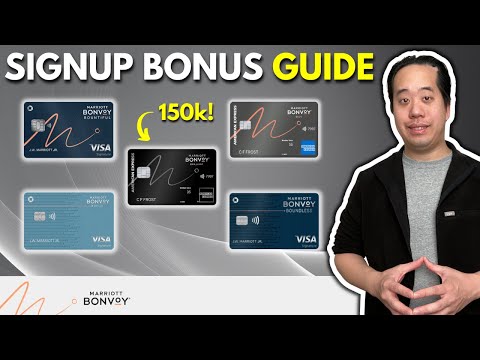

There are a total of 5 personal Marriott Bonvoy cards available, offered by Chase and American Express. These cards include the Marriott Bonvoy Bold, Boundless, Bountiful, Bevy and Brilliant. Each card comes with its own annual fee, ranging from $0 to $650.

Signup Bonuses and Multipliers

Now let’s talk about the exciting part: the signup bonuses! Each card offers a different sign-up bonus, ranging from 60,000 to 150,000 Marriott points. The spending requirements for these bonuses range from $2,000 to $5,000 over a 3-month period.

In terms of multipliers, Marriott Bonvoy cards offer benefits for different spending categories. These include 3X Marriott points, 2X travel and 1X on everything else for the Bold card, and 6X Marriott points, 4X grocery and dining and 2X on everything else for the Bevy card, to name a few .

Elite Status and Free Night Rewards

When it comes to elite status, Marriott Bonvoy cards have you covered. The Boundless and Bevy cards offer Gold Elite status, while the Brilliant card offers Platinum Elite status. Plus, each card comes with free nights, allowing you to enjoy a stay at select Marriott properties.

For example, with the Brilliant card, you can receive a free night worth up to 85,000 Marriott points. Plus, you’ll earn elite night credits with each card, ranging from 15 to 25 credits.

Terms and conditions

It is essential to know the terms and conditions of sign-up bonuses. American Express and Chase have their own credit card rules that apply to these Marriott Bonvoy cards. For example, American Express has a one-size-fits-all rule, while Chase has a 24-month waiting period for cardholder bonuses.

To make things easier, we’ve detailed the specific requirements for each card and highlighted any restrictions. This is important to consider before applying for a new Marriott Bonvoy credit card.

Which card to choose?

While all Marriott Bonvoy cards have their own benefits, if you’re looking for a premium credit card with great perks, we recommend the American Express Brilliant Card. With Platinum Elite status, a monthly dining credit, and an annual free night, this card offers exceptional value, despite its higher annual fee.

If you want to learn more about other credit card options, watch our video on how to get a free American Express Morgan Stanley Platinum Card.

Conclusion

The new Marriott Bonvoy credit cards offer enticing sign-up bonuses and exclusive perks. By understanding the terms and conditions, you can make an informed decision when applying for one of these cards. Choose the card that best suits your needs and enjoy the rewards offered as a Marriott Bonvoy cardholder.