1 US private auto insurers’ loss ratios shoot higher in 2021 – S&P Global

- Author: spglobal.com

- Published Date: 12/19/2021

- Review: 4.8 (981 vote)

- Summary: · … Insurance Co., the biggest writer of private auto insurance in 2021, with direct premiums written of $41.67 billion, saw its loss ratio

- Source: 🔗

2 What is loss ratio? | Reinsurance tutorials #30 – Blog

- Author: blog.ccr-re.com

- Published Date: 07/08/2022

- Review: 4.65 (544 vote)

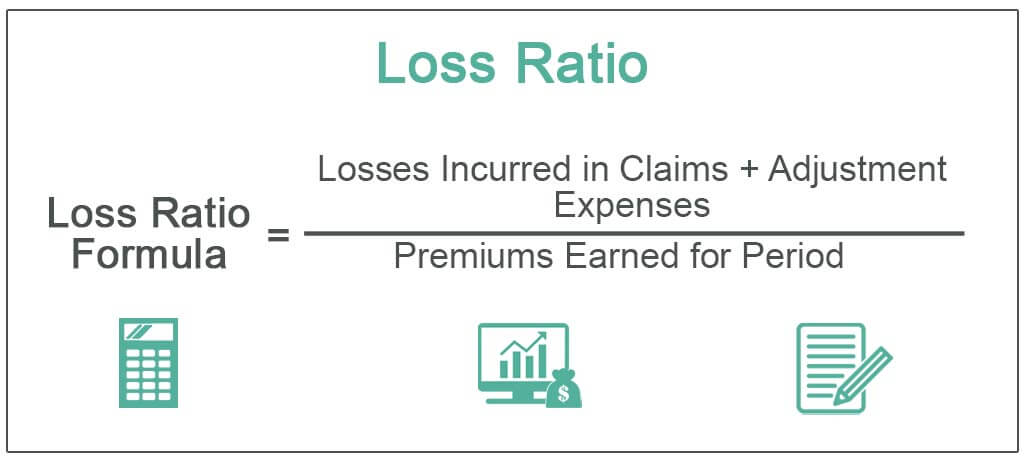

- Summary: The loss ratio is used by insurance and reinsurance companies. It is calculated as follows: cost of claims divided by premiums. It can be taken individually or

- Source: 🔗

3 Loss Ratio vs. Combined Ratio: What&39s the Difference?

- Author: investopedia.com

- Published Date: 09/02/2022

- Review: 4.53 (268 vote)

- Summary: A combined ratio measures the money flowing out of an insurance company in the form of dividends, expenses, and losses. Losses indicate the insurer’s discipline

- Source: 🔗

4 What is a loss ratio?

- Author: michigan.gov

- Published Date: 06/05/2022

- Review: 4.29 (335 vote)

- Summary: The loss ratio is a mathematical calculation that takes the total claims that have been reported to the carrier, plus the carrier’s costs to administer the

- Source: 🔗

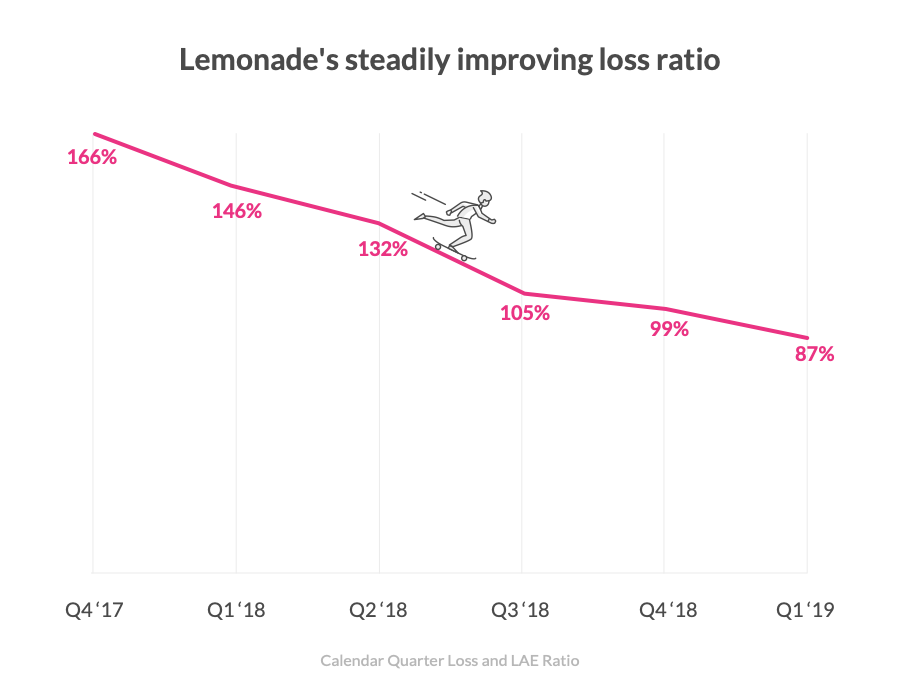

5 Nearly There: Why Lemonade’s Steadily Improving Loss Ratio Is

- Author: lemonade.com

- Published Date: 02/14/2022

- Review: 4.02 (576 vote)

- Summary: Insurance companies need to be around for the long haul. You pay them premium in advance to fulfill the promise of being there in the future when you need them

- Matching search results: 6. Driven by social good. Here’s my favorite differentiator from the incumbents. Typically, when insurance companies see a bad loss ratio, they increase prices. They’re focused on their bottom line. At Lemonade we very deliberately did not raise …

- Source: 🔗

6 Loss Ratio – Overview, Formula, Purpose and Interpretation

- Author: corporatefinanceinstitute.com

- Published Date: 07/07/2022

- Review: 3.95 (448 vote)

- Summary: · The loss ratio, used primarily in the insurance industry, is a ratio of losses paid out to premiums earned, expressed as a percentage

- Matching search results: 6. Driven by social good. Here’s my favorite differentiator from the incumbents. Typically, when insurance companies see a bad loss ratio, they increase prices. They’re focused on their bottom line. At Lemonade we very deliberately did not raise …

- Source: 🔗

7 The Different Types of Loss Ratio

- Author: gocardless.com

- Published Date: 09/23/2022

- Review: 3.6 (370 vote)

- Summary: The loss ratio is used by insurance companies to give an in-depth overview of their financial performance. Specifically, it represents the ratio of losses

- Matching search results: As already stated, loss ratio is a value used in the insurance industry to indicate the ratio of losses to premiums earned. Losses include paid insurance claims, i.e. when someone requires the use of their insurance, and adjustment expenses, i.e. …

- Source: 🔗

8 Loss Ratio Calculator for Insurance Companies

- Author: omnicalculator.com

- Published Date: 05/26/2022

- Review: 3.51 (318 vote)

- Summary: · Loss ratio, or underwriting loss ratio, represents the ratio of the loss an insurance company makes to the total premium it earns from its

- Matching search results: As already stated, loss ratio is a value used in the insurance industry to indicate the ratio of losses to premiums earned. Losses include paid insurance claims, i.e. when someone requires the use of their insurance, and adjustment expenses, i.e. …

- Source: 🔗

9 Medical Loss Ratio Data and System Resources

- Author: cms.gov

- Published Date: 07/29/2022

- Review: 3.27 (373 vote)

- Summary: The Affordable Care Act requires health insurance companies to disclose how much they spend on health care and how much they spend on administrative costs,

- Matching search results: As already stated, loss ratio is a value used in the insurance industry to indicate the ratio of losses to premiums earned. Losses include paid insurance claims, i.e. when someone requires the use of their insurance, and adjustment expenses, i.e. …

- Source: 🔗

10 What is a Loss Ratio? | Definition + Examples – Square One Insurance

- Author: squareone.ca

- Published Date: 11/29/2021

- Review: 3.13 (267 vote)

- Summary: · In the insurance world, a loss ratio is one indicator of how financially stable an insurance company is. It’s the ratio of losses paid to

- Matching search results: The only way an insurance company can function is if they stay profitable. If they lose money to claim settlements year after year, eventually they’ll run out of money to pay claims altogether. They’d go out of business and make their customers …

- Source: 🔗

11 [XLS] Swiss Re Loss Ratio Development Triangles 2016

- Author: swissre.com

- Published Date: 06/14/2022

- Review: 2.99 (189 vote)

- Summary: The loss ratios in the triangle are not comparable to loss ratios disclosed in the Financial … Year, Ult Loss Ratio, Paid Losses, Case Reserves, IBNR

- Matching search results: The only way an insurance company can function is if they stay profitable. If they lose money to claim settlements year after year, eventually they’ll run out of money to pay claims altogether. They’d go out of business and make their customers …

- Source: 🔗

12 Medical loss ratio (MLR) – Glossary – HealthCare.gov

- Author: healthcare.gov

- Published Date: 04/16/2022

- Review: 2.83 (82 vote)

- Summary: A medical loss ratio of 80% indicates that the insurer is using the remaining 20 cents of each premium dollar to pay overhead expenses, such as marketing,

- Matching search results: The only way an insurance company can function is if they stay profitable. If they lose money to claim settlements year after year, eventually they’ll run out of money to pay claims altogether. They’d go out of business and make their customers …

- Source: 🔗

13 What Is a Loss Ratio?

- Author: thebalancemoney.com

- Published Date: 04/03/2022

- Review: 2.61 (50 vote)

- Summary: · Loss ratio reflects the amount of money an insurer earns in premium receipts minus the amount spent in claims payments and claims

- Matching search results: The only way an insurance company can function is if they stay profitable. If they lose money to claim settlements year after year, eventually they’ll run out of money to pay claims altogether. They’d go out of business and make their customers …

- Source: 🔗

14 Personal Auto Insurers’ Losses Keep Rising Due to Multiple Factors

- Author: iii.org

- Published Date: 08/19/2022

- Review: 2.59 (121 vote)

- Summary: · Combined ratio represents the difference between claims and expenses paid and premiums collected by insurers. A combined ratio below 100

- Matching search results: With more drivers returning to the road in 2022, this loss trend is expected to continue. The severity of the post-pandemic riskiness of U.S. highways is illustrated by the fact that traffic deaths – after decades of decline – have increased in the …

- Source: 🔗

15 Health Insurer Financial Performance in 2020 – KFF

- Author: kff.org

- Published Date: 08/05/2022

- Review: 2.39 (128 vote)

- Summary: · Each health insurance market has different administrative needs and costs, so lower medical loss ratios in one market do not necessarily

- Matching search results: We find that, by the end of 2020, gross margins per member per month across these four markets remained relatively high and medical loss ratios were relatively low or flat compared to recent years. These findings suggest that many insurers remained …

- Source: 🔗

16 Whats a Medical Loss Ratio (MLR)?

- Author: tuftshealthplan.com

- Published Date: 04/15/2022

- Review: 2.42 (120 vote)

- Summary: The Medical Loss Ratio requirement says that health insurance companies have to spend at least 80% of their premium income (excluding taxes and fees) from

- Matching search results: As mentioned before, premium payments that health insurers use to fund measures for improving health care quality and delivery count toward the medical cost portion of the loss ratio calculation. These measures include certain activities health …

- Source: 🔗

17 Understanding Insurance Company Loss Ratios

- Author: thedetectiongroup.com

- Published Date: 05/29/2022

- Review: 2.36 (144 vote)

- Summary: Pure loss ratio is computed by dividing total losses by total premium. As an example, if you are paying a $1,000 annual premium and have claims of $100, you

- Matching search results: As mentioned before, premium payments that health insurers use to fund measures for improving health care quality and delivery count toward the medical cost portion of the loss ratio calculation. These measures include certain activities health …

- Source: 🔗

18 Loss Ratio – Formula, Calculation, Uses in Insurance – WallStreetMojo

- Author: wallstreetmojo.com

- Published Date: 01/04/2022

- Review: 2.17 (65 vote)

- Summary: The loss ratio depicts the insurance company’s percentage loss on claim settlement compared to the premium received during a particular period

- Matching search results: Property and casualty insurance companies sometimes have a high loss ratio if the insured properties experience devastating events like floods, cyclones, or hailstorms. In such situations, these ratios surpass the 100% mark, and the companies pay …

- Source: 🔗

19 Loss Ratio | Insurance Glossary Definition – IRMI.com

- Author: irmi.com

- Published Date: 10/27/2021

- Review: 2.15 (106 vote)

- Summary: Loss Ratio — proportionate relationship of incurred losses to earned premiums expressed as a percentage. If, for example, a firm pays $100,000 of premium

- Matching search results: Property and casualty insurance companies sometimes have a high loss ratio if the insured properties experience devastating events like floods, cyclones, or hailstorms. In such situations, these ratios surpass the 100% mark, and the companies pay …

- Source: 🔗