1 What Is Insurance? – Investopedia

- Author: investopedia.com

- Published Date: 04/11/2022

- Review: 4.95 (725 vote)

- Summary: Insurance is a contract (policy) in which an insurer indemnifies another … permanent life insurance can be considered a financial asset because of its

- Source: 🔗

2 Does Insurance Expense Go on the Balance Sheet?

- Author: smallbusiness.chron.com

- Published Date: 01/29/2022

- Review: 4.65 (561 vote)

- Summary: If you prepay for a period of time on your business insurance policy, this payment is a type of asset, or something you own. This prepayment has value because

- Source: 🔗

3 Is Insurance an Asset or Liability?

- Author: policybachat.com

- Published Date: 03/05/2022

- Review: 4.59 (338 vote)

- Summary: Insurance coverage is the protection of assets or life of the insured against any specified perils mentioned in the insurance policy document

- Source: 🔗

4 Insurance Asset and Liability Management

- Author: moodysanalytics.com

- Published Date: 03/10/2022

- Review: 4.27 (225 vote)

- Summary: The modeling framework covers a comprehensive range of assets, liabilities, and risk management strategies. Our solution helps insurers face a range of asset

- Source: 🔗

5 Is Life Insurance an Asset?

- Author: thebalancemoney.com

- Published Date: 11/21/2021

- Review: 4.03 (376 vote)

- Summary: · Permanent life insurance policies can build a cash value, and may function as an asset. · Term insurance is not considered an asset, but provides

- Source: 🔗

6 Life Insurance as an Asset

- Author: unionbank.com

- Published Date: 02/05/2022

- Review: 3.96 (361 vote)

- Summary: · Life insurance is viewed as a significant asset. A relationship manager can help to uncover how it will fit into your financial portfolio as

- Matching search results: In retirement, you’ll draw income from a number of investment accounts that are either fully or partially taxed. A mix of permanent life insurance, along with other investment accounts, allows you to take tax-free loans from the cash value in your …

- Source: 🔗

7 Insurance and Asset Management – The World Economic Forum

- Author: weforum.org

- Published Date: 03/06/2022

- Review: 3.79 (355 vote)

- Summary: The Forum’s Industry Community for Insurance and Asset Management is an exclusive community of peers. Chief executives and chairs constitute the Industry

- Matching search results: In retirement, you’ll draw income from a number of investment accounts that are either fully or partially taxed. A mix of permanent life insurance, along with other investment accounts, allows you to take tax-free loans from the cash value in your …

- Source: 🔗

8 Our commitment: the protection of your assets

- Author: swissriskcare.ch

- Published Date: 05/04/2022

- Review: 3.39 (580 vote)

- Summary: Asset Insurance … Corporate civil liability covers you for damages caused to a third party due to your infrastructure (premises, installations), your activities

- Matching search results: In retirement, you’ll draw income from a number of investment accounts that are either fully or partially taxed. A mix of permanent life insurance, along with other investment accounts, allows you to take tax-free loans from the cash value in your …

- Source: 🔗

9 Background on: Insurance Accounting | III

- Author: iii.org

- Published Date: 12/03/2021

- Review: 3.33 (406 vote)

- Summary: As with GAAP accounting, the balance sheet presents a picture of a company’s financial position at one moment in time—its assets and its liabilities—and the

- Matching search results: By recognizing acquisition expenses before the premium income is fully earned, an insurance company is required to absorb those expenses in its policyholders’ surplus. This appears to reduce the surplus available at the inception of a policy to pay …

- Source: 🔗

10 Is Life Insurance a Liquid Asset?

- Author: harborlifesettlements.com

- Published Date: 12/28/2021

- Review: 3.19 (485 vote)

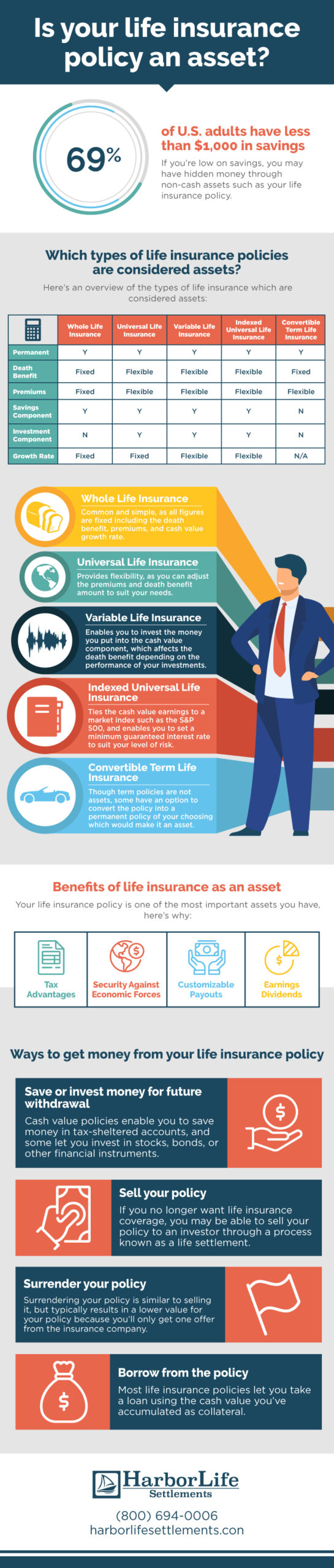

- Summary: Which types of life insurance policies are considered assets? … Some life insurance is considered an asset, and a liquid asset at that. As explained below,

- Matching search results: Permanent life insurance is a versatile asset that can play several roles in your financial plan. When you’re younger, the death benefit can ensure funding to your family if something happens to you. As you age and your cash value grows, your life …

- Source: 🔗

11 Is Life Insurance an Asset? [A Comprehensive Deep Dive]

![Top 20+ is insurance an asset 2 Is Life Insurance an Asset? [A Comprehensive Deep Dive]](https://www.insuranceandestates.com/wp-content/uploads/IBC-Webinar-thumbnail-updated-3-20-w-play-button-and-border-IE.png)

- Author: insuranceandestates.com

- Published Date: 03/10/2022

- Review: 2.99 (114 vote)

- Summary: · is insurance an asset And the simple answer is … Cash Value. … You see, unlike term life, permanent life insurance builds cash value. Now, some

- Matching search results: Unlike investment real estate property that typically provides cash flow income (i.e. cash in your pocket) to you in the form of rent, depreciation, amortization, and equity growth, your primary residence takes cash out of your pocket in the form of …

- Source: 🔗

12 Is Insurance An Expense Or An Asset?

- Author: singsaver.com.sg

- Published Date: 08/16/2022

- Review: 2.86 (97 vote)

- Summary: · Insurance Can Be an Asset When The Risk Exists … Now we go to the other side of the coin. Despite the explanation above, insurance policies don’

- Matching search results: Unlike investment real estate property that typically provides cash flow income (i.e. cash in your pocket) to you in the form of rent, depreciation, amortization, and equity growth, your primary residence takes cash out of your pocket in the form of …

- Source: 🔗

13 Is prepaid insurance an asset?

- Author: higginbotham.com

- Published Date: 12/07/2021

- Review: 2.75 (76 vote)

- Summary: · Anything that is owned by a company and has a future value that can be measured in money is considered an asset. This includes cash, accounts

- Matching search results: A prepaid insurance contract is recorded initially as an asset. Adjusting journal entries are then needed each month so that (1) the current month’s expense is recorded on each month’s income statement; and (2) the unexpired amount of the prepaid …

- Source: 🔗

14 INSURANCE CODE CHAPTER 422. ASSET PROTECTION ACT

- Author: statutes.capitol.texas.gov

- Published Date: 11/13/2021

- Review: 2.57 (199 vote)

- Summary: (2) provide preferential claims against assets in favor of an owner, beneficiary, assignee, certificate holder, or third-party beneficiary of an insurance

- Matching search results: A prepaid insurance contract is recorded initially as an asset. Adjusting journal entries are then needed each month so that (1) the current month’s expense is recorded on each month’s income statement; and (2) the unexpired amount of the prepaid …

- Source: 🔗

15 What is insurance expense? | AccountingCoach

- Author: accountingcoach.com

- Published Date: 07/17/2022

- Review: 2.46 (122 vote)

- Summary: Definition of Insurance Expense Under the accrual basis of accounting, insurance … Any prepaid insurance costs are to be reported as a current asset

- Matching search results: A prepaid insurance contract is recorded initially as an asset. Adjusting journal entries are then needed each month so that (1) the current month’s expense is recorded on each month’s income statement; and (2) the unexpired amount of the prepaid …

- Source: 🔗

16 What Type of Asset is Life Insurance?

- Author: lsa-llc.com

- Published Date: 03/19/2022

- Review: 2.31 (157 vote)

- Summary: Does Term Life Insurance Count as an Asset? · If the term policy is sold for profit while you are alive. Any earnings count toward your liquid financial assets

- Matching search results: An asset’s main objective is for you to collect a payout from it in the future. With term life insurance, when the policy is paid out, it only benefits your beneficiaries. There are a few rare cases where proceeds from a term life insurance policy …

- Source: 🔗

17 Want to Super-Charge Your Life Insurance? Heres How to Make It an Asset

- Author: smartasset.com

- Published Date: 03/28/2022

- Review: 2.23 (171 vote)

- Summary: · The answer is that yes, life insurance is an asset if it accumulates cash value. So what is cash value? When you purchase a permanent life

- Matching search results: An asset’s main objective is for you to collect a payout from it in the future. With term life insurance, when the policy is paid out, it only benefits your beneficiaries. There are a few rare cases where proceeds from a term life insurance policy …

- Source: 🔗

18 Insurance asset management – BlackRock

- Author: blackrock.com

- Published Date: 04/06/2022

- Review: 2.23 (142 vote)

- Summary: BlackRock is one of the very few asset managers to offer active and index capabilities globally and at scale on a single platform across equity,

- Matching search results: In summary, a person who can both be classified as a professional client under the Markets in Financial Instruments Directive and a qualified investor in accordance with the Prospectus Directive will generally need to meet one or more of the …

- Source: 🔗

19 Is Life Insurance an Asset or a Liability?

- Author: paradigmlife.net

- Published Date: 08/07/2022

- Review: 1.99 (117 vote)

- Summary: · Any type of life insurance that earns cash value is considered an asset. Whole life and universal life are two of the most common cash value

- Matching search results: If you own a life insurance policy or are thinking about purchasing one, where does it fit on your balance sheet? You have to pay a monthly, quarterly or annual premium, so is it a liability? It might seem that way, but the answer is it depends on …

- Source: 🔗

20 Insurance can protect your assets

- Author: wolterskluwer.com

- Published Date: 08/13/2022

- Review: 1.95 (156 vote)

- Summary: In contrast to liability insurance, which is a last resort for asset protection, property insurance is your first line of defense when your property is

- Matching search results: You may be able to have other people pay for the insurance on your property as a term of using the property. This is the strategy a mortgage company uses when they require you to carry homeowner’s insurance that actually protects the their …

- Source: 🔗

21 Insurance: business property and assets

- Author: nibusinessinfo.co.uk

- Published Date: 11/15/2021

- Review: 1.87 (131 vote)

- Summary: Insurance can protect your business from financial losses due to property damage or the loss of physical assets such as business equipment, vehicles,

- Matching search results: You may be able to have other people pay for the insurance on your property as a term of using the property. This is the strategy a mortgage company uses when they require you to carry homeowner’s insurance that actually protects the their …

- Source: 🔗

22 Is life insurance an asset?

- Author: policygenius.com

- Published Date: 10/13/2021

- Review: 1.86 (147 vote)

- Summary: · The cash value portion of permanent life insurance is considered an asset, but term life insurance is not

- Matching search results: You may be able to have other people pay for the insurance on your property as a term of using the property. This is the strategy a mortgage company uses when they require you to carry homeowner’s insurance that actually protects the their …

- Source: 🔗

23 Overview of Fixed Asset Insurance – Oracle Help Center

- Author: docs.oracle.com

- Published Date: 06/10/2022

- Review: 1.61 (162 vote)

- Summary: You can view and enter insurance information for an asset and assign more than one type of insurance to an asset. Asset insurance information includes insurance

- Matching search results: You may be able to have other people pay for the insurance on your property as a term of using the property. This is the strategy a mortgage company uses when they require you to carry homeowner’s insurance that actually protects the their …

- Source: 🔗