1 The Rise of Corporate VC in Insurtech – Corey Davis

- Author: senahill.com

- Published Date: 11/14/2021

- Review: 4.88 (813 vote)

- Summary: Insurance Technology or InsureTech is the new “it” sector of start-up land. … well-known companies set up their own corporate venture capital (“CVC”) arms

- Matching search results: Insurance Technology or InsureTech is the new “it” sector of start-up land. The narrative around InsureTech goes something like this: Insurance is a $4+ Trillion, capital “T”, market opportunity whose “incumbents” have yet to offer a compelling …

- Source: 🔗

2 Venture Capital Insurance: Asset Protection | Embroker

- Author: embroker.com

- Published Date: 03/11/2022

- Review: 4.74 (221 vote)

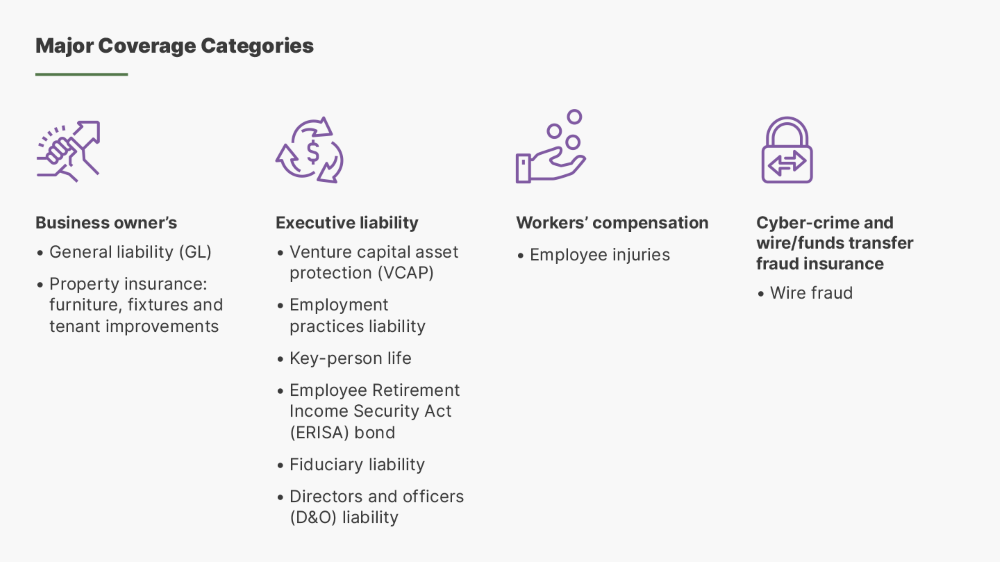

- Summary: Embroker’s VC Asset Protection Package combines four coverages into one comprehensive policy package to provide venture capital firms sophisticated and

- Matching search results: So what’s the difference between private equity and venture capital firms? Private equity means that there is a shared interest in a private company, one that’s not publicly listed or traded. The industry relies mostly on pension funds and other …

- Source: 🔗

3 VC Insurance 101: Protecting Your Fund, Your Investors and Yourself

- Author: svb.com

- Published Date: 08/16/2022

- Review: 4.42 (492 vote)

- Summary: · The standard recommendation for VCAP is approximately $1 million of coverage for every $100 million in committed capital. As your assets under

- Matching search results: Insurance providers typically take a comprehensive approach to the coverage they’re trying to sell you, which can often be overkill. That said, you don’t want to be caught without adequate coverage in critical areas. Careful assessment of your …

- Source: 🔗

4 Venture Capitalists Are Willing to Invest in Insurance Startups

- Author: finsmes.com

- Published Date: 11/24/2021

- Review: 4.37 (239 vote)

- Summary: · Investing in the demanding future: Venture capital funding in insurance startups. New insurance businesses are doing their best to overcome

- Matching search results: Surprisingly, quite a few venture capitalists are betting on insurance startups to succeed. In the past couple of years, these upstarts have succeeded in securing financing to penetrate an industry with numerous entry barriers. The point is that …

- Source: 🔗

5 Venture Capital Insurance is an Investment, Not a Cost

- Author: foundershield.com

- Published Date: 07/25/2022

- Review: 3.99 (420 vote)

- Summary: · Venture capital insurance is a versatile risk management tool for firms of any size. It will allow you to focus more on the reasons you got into

- Matching search results: Situation #4: One of your portfolio companies goes bankrupt and the board member you put in place is named as a defendant in a lawsuit from the trust. (See the Just For Feet bankruptcy case — thanks to industry veteran Kevin LaCroix who runs the …

- Source: 🔗