1 Understanding the Basics of Infinite Banking

- Author: paradigmlife.net

- Published Date: 03/09/2022

- Review: 4.98 (634 vote)

- Summary: · Infinite Banking is NOT whole life insurance. But the Infinite Banking concept works best when the banker—you—utilizes properly structured whole

- Matching search results: Additionally, policy loans are tax-free. You can use the interest and dividends you’ve earned without paying taxes on that money. Comparatively, if you withdraw your cash value, any amount over your basis—the amount you’ve contributed in insurance …

- Source: 🔗

2 5 Steps to Be Your Own Bank with Whole Life Insurance

- Author: bankingtruths.com

- Published Date: 12/26/2021

- Review: 4.71 (513 vote)

- Summary: Becoming Your Own Banker – The Infinite Banking Concept * by Nelson Nash; Bank on Yourself ** by Pamela Yellen (see footnotes for trademark details). Upon first

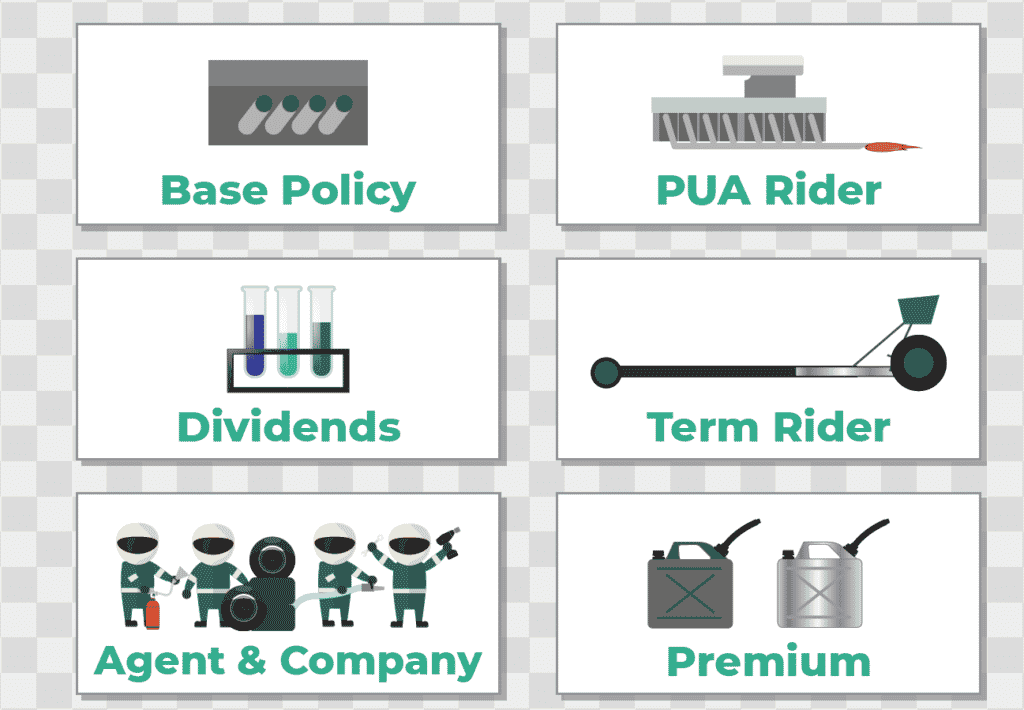

- Matching search results: The way to outrun the internal costs of a Whole Life policy is to pay additional premium over and above the amount required for the basic coverage. In fact, you will want to pay substantially more when becoming your own banker… as much premium as …

- Source: 🔗

3 Top 10 Best Infinite Banking Companies [High Cash Value Whole Life Insurance]

![Top 9 infinite banking whole life insurance 3 Top 10 Best Infinite Banking Companies [High Cash Value Whole Life Insurance]](https://www.insuranceandestates.com/wp-content/uploads/IBC-Webinar-thumbnail-updated-3-20-w-play-button-and-border-IE.png)

- Author: insuranceandestates.com

- Published Date: 08/28/2022

- Review: 4.39 (351 vote)

- Summary: · By eliminating the banks from the equation and funding all your purchases through your Whole Life Insurance Infinite Banking policy,

- Matching search results: We at I&E believe this is a great company. However, if we had one negative to speak of it would be the lower ratings it has received in contrast to its peers. MTL has a Comdex ranking of 78, which reflects a lower overall financial rating vs the …

- Source: 🔗

4 The Official Site for the Infinite Banking Concept – R. Nelson Nash

- Author: infinitebanking.org

- Published Date: 04/28/2022

- Review: 4.21 (350 vote)

- Summary: In his definitive book on the subject, Becoming Your Own Banker, Nash explains how whole life insurance policies uniquely function as dividend paying assets

- Matching search results: The NNI is named after the late Nelson Nash, financing pioneer, creative visionary, and creator of the Infinite Banking Concept. Nash is a firm believer in the “Austrian School” of economics, a school of thought advocating for the economic benefits …

- Source: 🔗

5 Infinite Banking Explained – How to Become Your Own Bank

- Author: insurancegeek.com

- Published Date: 11/27/2021

- Review: 4.18 (356 vote)

- Summary: · In essence, infinite banking makes use of the cash value of whole life insurance policies – also known as permanent life insurance – to

- Matching search results: The liquidity means that infinite banking through whole life insurance can serve you in emergencies, such as unforeseen expenses, medical bills, repairs, and so on. The cash value loan from your policy can even be used to buy real estate – or as a …

- Source: 🔗

6 Understanding Infinite Banking: Does It Make Sense For You?

- Author: thecollegeinvestor.com

- Published Date: 08/06/2022

- Review: 3.85 (337 vote)

- Summary: This is the concept of “becoming your own bank”. The infinite part of infinite banking refers to the whole

- Matching search results: The idea of having this “fund” that you can tap at any time sounds appealing, but there are always downsides. Insurance companies aren’t offering these policies out of the kindness of their heart. They are offering these policies to make money, and …

- Source: 🔗

7 The Infinite Banking Concept Explained | Easy Shoppers Guide

- Author: affordablelifeusa.com

- Published Date: 10/25/2021

- Review: 3.76 (465 vote)

- Summary: Whole Life Insurance – Whole life is popular for infinite banking because the cash values, premiums, and death benefits are guaranteed, while dividends can

- Matching search results: The idea of having this “fund” that you can tap at any time sounds appealing, but there are always downsides. Insurance companies aren’t offering these policies out of the kindness of their heart. They are offering these policies to make money, and …

- Source: 🔗

8 Infinite Banking, or How to Keep Your Money and Spend It Too

- Author: moneywise.ca

- Published Date: 03/18/2022

- Review: 3.39 (465 vote)

- Summary: · Infinite banking starts with the purchase of a whole life insurance policy. In addition to providing benefits in the event of a person’s

- Matching search results: It may be tempting to take out a loan against your life insurance to make a revenue-earning investment, as the interest is tax-deductible. But it can leave an individual’s family unprotected if the investment falls through and the loan can’t be …

- Source: 🔗

9 Be Your Own Bank: Cash Flow Banking is Appealing, but It’s Rarely Practical

- Author: cnet.com

- Published Date: 08/30/2022

- Review: 3.28 (578 vote)

- Summary: · Cash flow banking, also known as “infinite banking”, is designed to … The cash flow banking strategy is built upon whole life insurance

- Matching search results: The first step is to purchase a whole life insurance policy. Next, you’ll have to wait a while – like decades – for your policy to increase in value. Ultimately, when you need a loan, you can borrow against your policy instead of a loan secured from …

- Source: 🔗