1 Infinite Banking – Definition, Example, How Does it Work?

- Author: wallstreetmojo.com

- Published Date: 02/11/2022

- Review: 4.94 (824 vote)

- Summary: Infinite banking is a concept that allows the policyholder to take up loans on the whole life insurance policy. Such loans should be available when there is a

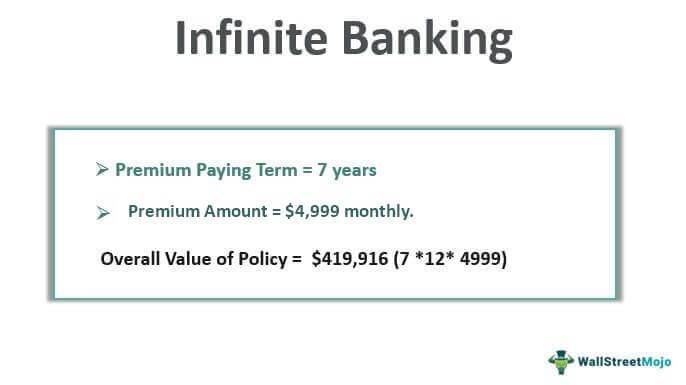

- Matching search results: Suppose an individual enrolls for a whole life insurance policy with a premium paying term of 7 years and a policy period of 20 years. The individual took the policy when he was 34 years old. He has served seven years of the policy and is now 41 …

- Source: 🔗

2 How to Take Whole Life Insurance Policy Loans – Infinite Banking

- Author: safepacific.com

- Published Date: 08/30/2022

- Review: 4.66 (270 vote)

- Summary: The beauty of the Infinite Banking Concept is its simplicity: use a dividend-paying whole life insurance policy to create a pool of money so you can access

- Matching search results: Yes, you can. You are contractually guaranteed to receive your money from the life insurance company when you ask for it. In some larger cases, for corporate clients, you can potentially borrow against non-guaranteed dividends – this is called an …

- Source: 🔗

3 Infinite Banking: Buyers Guide (Companies Rates)

- Author: effortlessinsurance.com

- Published Date: 06/11/2022

- Review: 4.42 (422 vote)

- Summary: · Infinite Banking is the idea of using your whole life insurance policy as a personal bank · You can take out loans from the cash value of your

- Matching search results: Whole life insurance policies come with a cash value, that is, the amount of your life insurance’s death benefit the insurance company makes liquid to you. If you cancel your policy while still alive, the insurance company would pay you that cash …

- Source: 🔗

4 Infinite Banking Concept: How to Turn Your Life Insurance Policy Into Your Bank (Unabridged)

- Author: books.apple.com

- Published Date: 01/23/2022

- Review: 4.21 (281 vote)

- Summary: Infinite Banking Concept: How to Turn Your Life Insurance Policy Into Your Bank (Unabridged) · Publisher Description · Listeners Also Bought

- Matching search results: Whole life insurance policies come with a cash value, that is, the amount of your life insurance’s death benefit the insurance company makes liquid to you. If you cancel your policy while still alive, the insurance company would pay you that cash …

- Source: 🔗

5 Bank on Yourself: Using Life Insurance as a Source of Liquidity

- Author: nerdwallet.com

- Published Date: 03/31/2022

- Review: 4.06 (391 vote)

- Summary: · First, there was LEAP. Then there was Infinite Banking, also known as Be Your Own Banker. Now it’s Bank on Yourself. Here’s the rub

- Matching search results: Whole life insurance policies come with a cash value, that is, the amount of your life insurance’s death benefit the insurance company makes liquid to you. If you cancel your policy while still alive, the insurance company would pay you that cash …

- Source: 🔗

6 Be Your Own Bank: Cash Flow Banking is Appealing, but It’s Rarely Practical

- Author: cnet.com

- Published Date: 04/30/2022

- Review: 3.98 (258 vote)

- Summary: · Cash flow banking, also known as “infinite banking”, is designed to … The cash flow banking strategy is built upon whole life insurance

- Matching search results: Whole life insurance is significantly more expensive. According to PolicyGenius, the average term life insurance premium costs between $21 and $152 per month. Whole life insurance covers you for the entirety of your life – so you don’t have to worry …

- Source: 🔗

7 3 Biggest Secrets To Your Infinite Banking System Using Whole Life Insurance With Mark Willis

- Author: linkedin.com

- Published Date: 11/20/2021

- Review: 3.68 (495 vote)

- Summary: · Well, the hidden fact is that this is what banks are doing. They’re using a little known variation of life insurance to be able to be part of

- Matching search results: Well, the hidden fact is that this is what banks are doing. They’re using a little known variation of life insurance to be able to be part of their tier one capital. And part of their capital reserve requirements that they used to have before …

- Source: 🔗

8 What is The Infinite Banking Concept? What Are The Pros and Cons?

- Author: playlouder.com

- Published Date: 07/30/2022

- Review: 3.47 (361 vote)

- Summary: · It goes by many names (the ‘perpetual wealth code’, ‘cashflow banking’, or the ‘money multiplier), but infinite banking involves borrowing

- Matching search results: You can take out a loan from yourself by calling your insurance company and asking for a check to be issued. Though you may not have a lot of cash value built up, some sources report that you can take out a loan starting as early as one month into …

- Source: 🔗

9 Understanding the Basics of Infinite Banking

- Author: paradigmlife.net

- Published Date: 05/16/2022

- Review: 3.34 (484 vote)

- Summary: · If you use a participating whole life insurance policy for Infinite Banking, your cash value increases every time the insurance company pays

- Matching search results: While there are other types of permanent life insurance, whole life insurance is guaranteed to have the same premium for the duration of the policy. You can be certain your premium won’t increase as you get older. This is invaluable when it comes to …

- Source: 🔗

10 What Is Infinite Banking? Could You Be Your Own Banker?

- Author: moneyrates.com

- Published Date: 03/24/2022

- Review: 3.07 (560 vote)

- Summary: · To use infinite banking, you must purchase a whole life insurance policy. This type of policy remains in effect until your death as long as you

- Matching search results: Whole life insurance policies are not cheap. In fact, it is common for policyholders to spend at least 10% of their annual income to fund such a policy, according to the Corporate Finance Institute, which provides online financial analyst …

- Source: 🔗

11 A Financial Advisors Review of Infinite Banking

- Author: physiciansthrive.com

- Published Date: 12/22/2021

- Review: 2.88 (87 vote)

- Summary: · Infinite banking is only possible with a permanent life insurance policy, and not everyone qualifies for one. A life insurance policy ties to

- Matching search results: There is a cap on how much money you can contribute to a life insurance policy, and that cap is determined, in part, by the amount of the policy’s death benefit. Practicing infinite banking may tempt you into overfunding your account as quickly as …

- Source: 🔗

12 The Official Site for the Infinite Banking Concept – R. Nelson Nash

- Author: infinitebanking.org

- Published Date: 11/13/2021

- Review: 2.76 (71 vote)

- Summary: As Nash famously taught, the equity, or cash value(s) specific to whole life insurance policies serve as collateral for all policy loans. So long as premiums

- Matching search results: As Nash famously taught, the equity, or cash value(s) specific to whole life insurance policies serve as collateral for all policy loans. So long as premiums are current, the policyholder simply calls the insurance company and requests a loan …

- Source: 🔗

13 Infinite Banking Concept: The Definitive Guide

- Author: lsminsurance.ca

- Published Date: 05/22/2022

- Review: 2.79 (104 vote)

- Summary: Infinite banking is a personal finance strategy that leverages a whole life policy as a “personal bank.” This includes taking loans against the policy and

- Matching search results: As Nash famously taught, the equity, or cash value(s) specific to whole life insurance policies serve as collateral for all policy loans. So long as premiums are current, the policyholder simply calls the insurance company and requests a loan …

- Source: 🔗

14 Infinite Banking: What Is It and How Does It Work?

- Author: gobankingrates.com

- Published Date: 12/30/2021

- Review: 2.57 (184 vote)

- Summary: · The Infinite Banking Concept revolves around a whole life insurance policy. Whole life insurance, versus the more common term life insurance, is

- Matching search results: As Nash famously taught, the equity, or cash value(s) specific to whole life insurance policies serve as collateral for all policy loans. So long as premiums are current, the policyholder simply calls the insurance company and requests a loan …

- Source: 🔗

15 Understanding Infinite Banking: Does It Make Sense For You?

- Author: thecollegeinvestor.com

- Published Date: 09/01/2022

- Review: 2.41 (100 vote)

- Summary: · This is the concept of “becoming your own bank”. The infinite part of infinite banking refers to the whole life insurance payout when you die

- Matching search results: The idea of having this “fund” that you can tap at any time sounds appealing, but there are always downsides. Insurance companies aren’t offering these policies out of the kindness of their heart. They are offering these policies to make money, and …

- Source: 🔗

16 Infinite Banking Concept Pros and Cons [How to Become Your Own Banker in 2022]

![The list of 20+ infinite banking life insurance 5 Infinite Banking Concept Pros and Cons [How to Become Your Own Banker in 2022]](https://www.insuranceandestates.com/wp-content/uploads/Boost-Real-Estate-Income.jpg)

- Author: insuranceandestates.com

- Published Date: 01/20/2022

- Review: 2.47 (175 vote)

- Summary: · As with any life insurance policy, you must qualify for an infinite banking policy.This means that if you have existing health problems, it

- Matching search results: It is true compound interest because you are never touching your actual principle, but instead are borrowing from the carrier’s general fund. That way your money in your policy is continually compounding, even while you are paying simple interest on …

- Source: 🔗

17 Infinite Banking and Real Estate Investing

- Author: innovativeretirementstrategies.com

- Published Date: 08/20/2022

- Review: 2.38 (58 vote)

- Summary: So let’s start by referring to “Infinite Banking Concept“, “Be Your Own Bank“, “Bank on Yourself” “7702 Plans” and other Life Insurance marketing systems as

- Matching search results: None of these strategies were originally intended for leveraging the cash value for real estate investing. There is nothing to stop you from leveraging the cash value to invest in real estate. But, in order to maximize profits, Real Estate Investors …

- Source: 🔗

18 Infinite banking life insurance is the latest TikTok trend — but is it a scam?

- Author: policygenius.com

- Published Date: 08/09/2022

- Review: 2.26 (107 vote)

- Summary: · The concept, as Flocka and other infinite banking fanatics make it sound, is easy — you open a life insurance policy that generates money, and

- Matching search results: None of these strategies were originally intended for leveraging the cash value for real estate investing. There is nothing to stop you from leveraging the cash value to invest in real estate. But, in order to maximize profits, Real Estate Investors …

- Source: 🔗

19 Infinite Banking Explained – How to Become Your Own Bank

- Author: insurancegeek.com

- Published Date: 06/01/2022

- Review: 2.15 (57 vote)

- Summary: · In essence, infinite banking makes use of the cash value of whole life insurance policies – also known as permanent life insurance – to

- Matching search results: You can use our life insurance quote calculator to get free quotes from multiple insurers on our site. Our carriers are top names in the insurance industry that only sell high-quality life insurance products – including Nationwide, Penn Mutual, …

- Source: 🔗

20 The Truth About Term Rider and Infinite Banking [2022 Guide]

- Author: pinnaclequote.com

- Published Date: 06/19/2022

- Review: 2.04 (104 vote)

- Summary: · Infinite Banking is when you maximize your whole life insurance policy cash value growth to become your own banker as your liquidity is always

- Matching search results: But to keep it simple, funding a whole life with paid-up additions where you can borrow against the cash value of the policy to finance your purchases like real estate investments or supplemented income is a concept best explained by R. Nelson Nash. …

- Source: 🔗

21 Infinite Banking, or How to Keep Your Money and Spend It Too

- Author: moneywise.ca

- Published Date: 04/30/2022

- Review: 1.94 (53 vote)

- Summary: · Infinite banking starts with the purchase of a whole life insurance policy. In addition to providing benefits in the event of a person’s

- Matching search results: Infinite banking can be an intriguing method of accessing cash. Need $50,000 for your kid’s education or $10,000 for a long overdue holiday? Borrowing the funds from your insurance provider can help you pay for the things you need without having to …

- Source: 🔗

22 Infinite Banking – Becoming Your Own Banker

- Author: corporatefinanceinstitute.com

- Published Date: 12/01/2021

- Review: 1.74 (134 vote)

- Summary: · In Nash’s infinite banking concept (IBC), the cash surrender value(s) of whole life insurance policies act as collateral for a loan

- Matching search results: Infinite banking can be an intriguing method of accessing cash. Need $50,000 for your kid’s education or $10,000 for a long overdue holiday? Borrowing the funds from your insurance provider can help you pay for the things you need without having to …

- Source: 🔗

23 The Infinite Banking Concept Explained

- Author: bankingtruths.com

- Published Date: 11/14/2021

- Review: 1.77 (142 vote)

- Summary: The infinite banking concept (IBC) is a system whereby one becomes their own banker by growing their liquid cash value inside a properly-designed whole life

- Matching search results: This is a great time to discuss Whole Life’s “loan” component, even though it’s thought of as a 4-letter word. But remember how I said that compounding is the most important ingredient of the infinite banking concept? Borrowing against your infinite …

- Source: 🔗

24 The Infinite Banking Concept Explained | Easy Shoppers Guide

- Author: affordablelifeusa.com

- Published Date: 11/03/2021

- Review: 1.63 (84 vote)

- Summary: Whole Life Insurance – Whole life is popular for infinite banking because the cash values, premiums, and death benefits are guaranteed, while dividends can

- Matching search results: This is a great time to discuss Whole Life’s “loan” component, even though it’s thought of as a 4-letter word. But remember how I said that compounding is the most important ingredient of the infinite banking concept? Borrowing against your infinite …

- Source: 🔗

25 What Is Infinite Banking? – CB Insights

- Author: cbinsights.com

- Published Date: 03/13/2022

- Review: 1.55 (79 vote)

- Summary: Infinite banking also seeks to take advantage of death benefits. One of the key features of whole life insurance is that death benefit payouts are

- Matching search results: This is a great time to discuss Whole Life’s “loan” component, even though it’s thought of as a 4-letter word. But remember how I said that compounding is the most important ingredient of the infinite banking concept? Borrowing against your infinite …

- Source: 🔗