Are you familiar with health insurance, homeowners insurance, and even pet insurance? Well, let’s talk about another kind of insurance – gap insurance. No, it’s not coverage for your fashionable khakis and stylish sweaters from the mall. It’s actually coverage for your car, more specifically, for the full value of your car.

You may already know that the moment you drive your car off the dealer’s lot, it loses roughly 10% of its value. And on average, your car will continue to depreciate 15 to 25 percent each year after that. That’s just the reality of car ownership. But what happens if something unfortunate occurs to your car before you have fully paid off your loan?

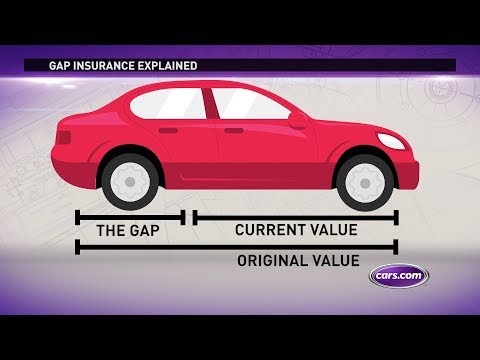

You might think that your comprehensive or collision insurance will cover you, right? Well, not necessarily. Here’s the thing – if your car is stolen and not recovered, or if it’s crashed and declared a total loss, your auto insurance carrier may not fully compensate you. Instead, they’ll reimburse you for the actual cash value of your car, which has been decreasing in value since you first owned it. And don’t forget about your deductible. So, even if your car depreciates faster than your loan balance reduces, you may still owe thousands of dollars more than what your policy pays out.

This is where gap insurance comes in. Gap insurance covers the difference between the actual cash value of your car and the amount you still owe on your loan. With gap insurance, you can breathe a little easier knowing that you won’t be left stranded financially if your car is deemed a total loss. You can simply head back to the dealership, get yourself a brand-new replacement ride, and all you’ll be out is your deductible and the time it takes to reprogram your stereo settings.

So, how do you get gap insurance? Well, you have a couple of options. You can purchase it as an add-on to your existing auto insurance policy for just a few extra bucks a month. Alternatively, you can also buy gap insurance from the dealer, usually for a price ranging from five hundred to a thousand dollars.

Now, if you own your car outright and don’t have a loan, gap insurance probably isn’t the best investment for you. You might feel lucky and decide to go without it. But if you prefer to be on the safe side, then as they say in London, “mind the gap.”

In conclusion, gap insurance is designed to protect you from facing a financial gap between the actual cash value of your car and the amount you owe on your loan. It’s an added layer of security that can save you from unexpected expenses and give you peace of mind. So, whether you choose to include it in your auto insurance policy or purchase it separately, having gap insurance ensures that you won’t be left hanging in the event of a total loss.

Remember, when it comes to protecting your investment, F4VN has got you covered. Check out our website for more information and to explore our range of insurance options.