Meet Emily.

Emily is in the process of buying a house in the suburbs. She has done her research on mortgages and financing options, but there’s one thing she still needs to figure out – homeowners insurance. If you’re in the same boat, don’t worry! We’re here to help you understand the basics of homeowners insurance so you can protect your dream home.

Understanding Homeowners Insurance

Just like any other type of insurance, homeowners insurance is designed to reduce the financial burden associated with certain risks. In this case, it protects your home from potential damages and covers any injuries that may occur on your property. But how does it work?

The Six Coverages in Homeowners Insurance

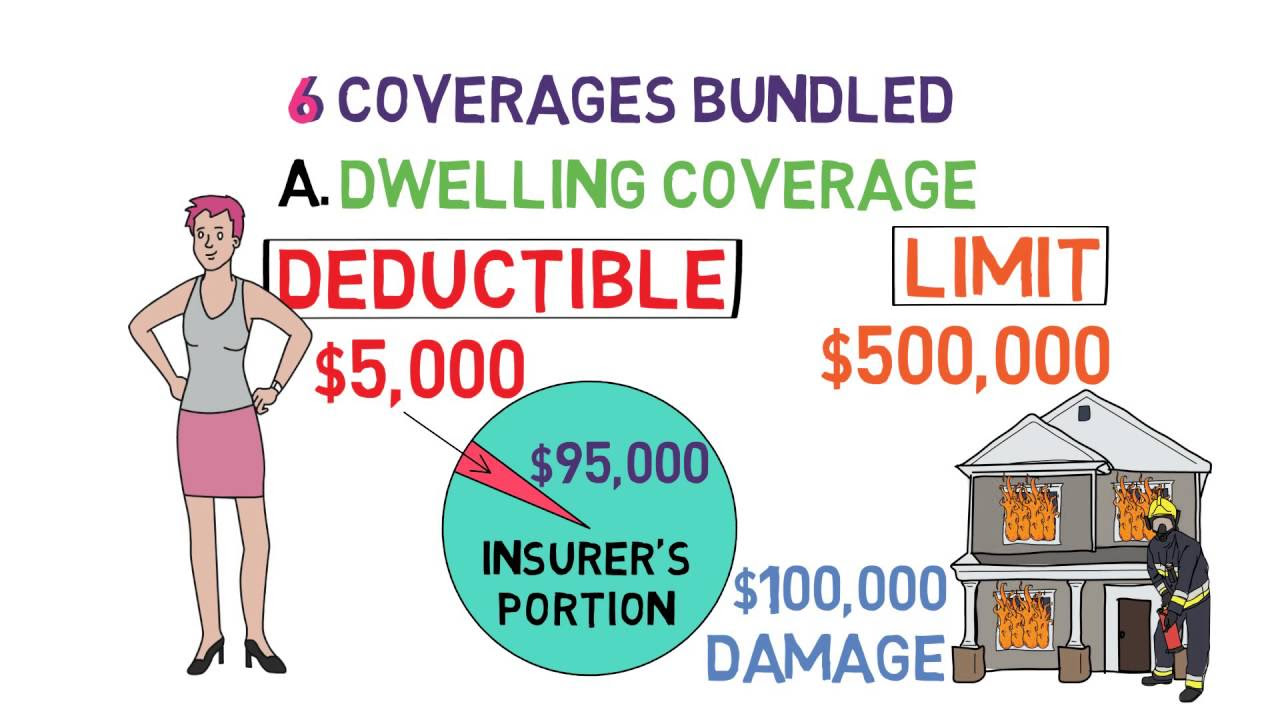

Homeowners insurance consists of six coverages bundled together. While not all of them are required by law, your mortgage lender will usually require them. Let’s go through each coverage:

1. Dwelling Coverage

Dwelling coverage is the most important part of homeowners insurance. It protects the structure of your home from theft and various disasters, except for floods and earthquakes, which require separate plans. In the event of a covered incident, you will have to pay a deductible, which is a predetermined amount, before your insurer covers the rest up to your policy limit.

2. Other Structures on Your Property Coverage

This coverage extends to structures like sheds, detached garages, and even outhouses on your property. It works in a similar way to dwelling coverage, with a set limit based on a percentage of your dwelling coverage.

3. Personal Property Coverage

Personal property coverage is all about protecting the contents of your home. If your belongings are damaged or stolen, this coverage helps cover the cost of replacing them. The limit for personal property coverage is also typically a percentage of your dwelling coverage.

4. Loss of Use Coverage

If your home becomes uninhabitable due to a covered incident, such as a fire or flood, this coverage helps cover the additional expenses you may incur. This can include hotel stays or temporary rental accommodations.

5. Personal Liability Coverage

Accidents can happen, and personal liability coverage protects you from lawsuits filed by individuals who are injured on your property. It provides financial protection and covers legal fees in such situations.

6. Medical Payments Coverage

In case someone gets injured on your property but doesn’t file a lawsuit, medical payments coverage helps cover their medical expenses. It provides peace of mind knowing that the injured party’s medical bills are taken care of.

How to Get Homeowners Insurance

Now that you understand the basics of homeowners insurance, you’re probably wondering how to get started. Don’t worry, we’ve got you covered! In our next video, we’ll walk you through the process of getting homeowners insurance and provide recommendations for great insurance providers.

In the meantime, visit the F4VN website for more educational resources and valuable information about homeowners insurance.

Remember, protecting your dream home is essential, and homeowners insurance is your safety net. Stay tuned for more valuable insights and tips from F4VN.