1 The Insurance Market 2021 – Hard market conditions bite…

- Author: embarkgroup.co.uk

- Published Date: 11/01/2021

- Review: 4.96 (900 vote)

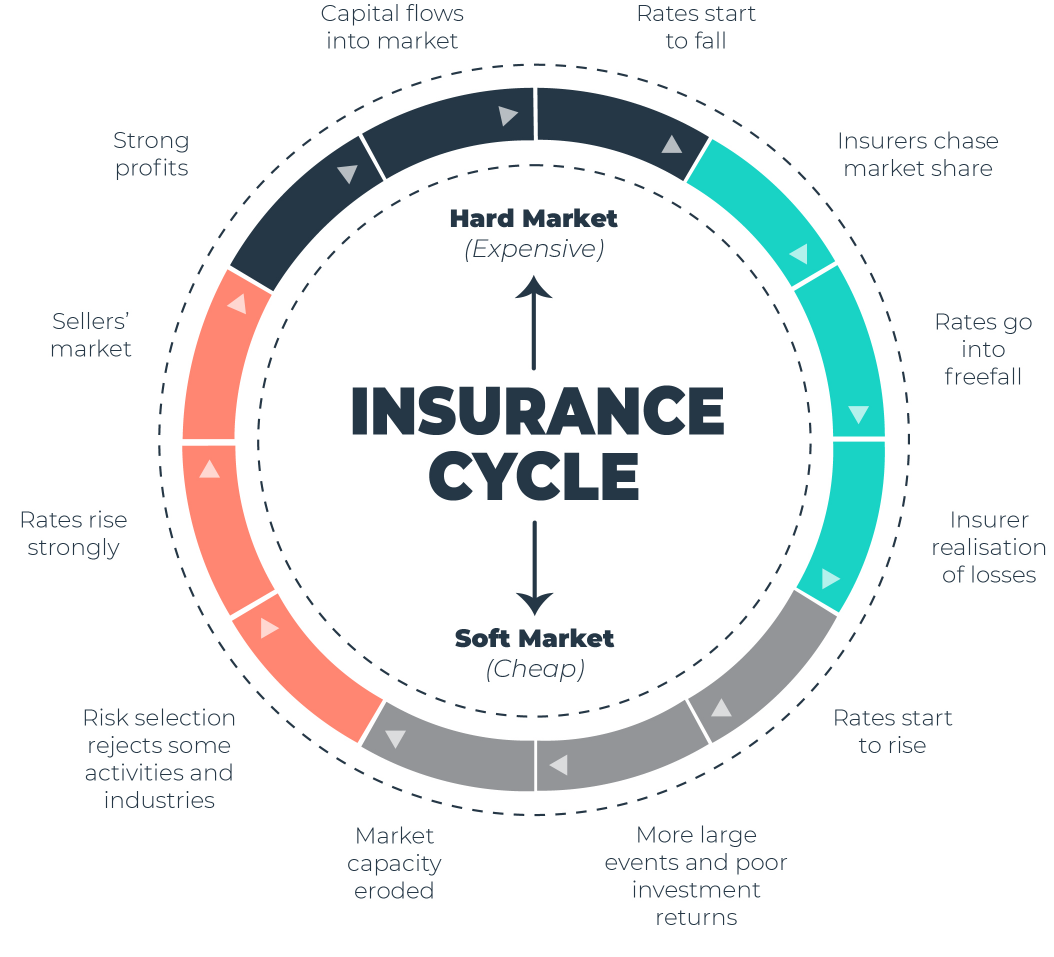

- Summary: · At any point during the year Insurance markets will either be witnessing ‘hard’ or ‘soft’ market conditions. So what is the difference?

- Matching search results: In a ‘hard’ market’ premiums begin to increase and the capacity for most types of insurance decreases. Insurers’ desire for new business reduces, they turn inward and take the time to re-evaluate their books of business and seek to use market …

- Source: 🔗

2 The insurance market is hardening, bringing increased premiums and tightening of terms. In this difficult environment it is more important than ever to work proactively with your broker

- Author: grpgroup.co.uk

- Published Date: 10/13/2022

- Review: 4.6 (394 vote)

- Summary: This Briefing note reviews current market conditions, and provides guidance on how to work with your broker to manage the hard market

- Matching search results: To avoid the imposition of restrictive terms, or the reduction of pay outs in the event of a claim, it is essential that you can demonstrate recent and accurate valuations. We now offer professional desktop rebuild valuations from our partner …

- Source: 🔗

3 What to Expect in a Hard Insurance Market

- Author: roanokegroup.com

- Published Date: 08/11/2022

- Review: 4.4 (422 vote)

- Summary: The insurance industry is highly cyclical. A soft market cycle is defined by lower insurance premiums, broader appetite and coverage, increased capacity

- Matching search results: Social inflation is a significant contributor to rising premiums and reductions in capacity in most liability coverage lines. Social inflation is a term used to describe the results of increasing litigation, broader definitions of liability, more …

- Source: 🔗

4 Hard Insurance Market | Professionalindemnity.co.uk

- Author: professionalindemnity.co.uk

- Published Date: 05/14/2022

- Review: 4.28 (345 vote)

- Summary: What causes a ‘hard’ insurance market? … The insurance market has been highly competitive or ‘soft’ for most of the last 15 years. Over this long period, market

- Matching search results: The insurance market has been highly competitive or ‘soft’ for most of the last 15 years. Over this long period, market rates dropped below profitable levels as insurers aggressively competed against each other for their market share, driving …

- Source: 🔗

5 Hard vs. Soft Insurance Markets Explained (with Video!)

- Author: frontrowinsurance.com

- Published Date: 11/23/2021

- Review: 4.08 (284 vote)

- Summary: Insurance rates are rising and premiums are increasing – this is known as a hard market. It is the cyclical opposite of a soft market when rates are decreasing

- Matching search results: The insurance market has been highly competitive or ‘soft’ for most of the last 15 years. Over this long period, market rates dropped below profitable levels as insurers aggressively competed against each other for their market share, driving …

- Source: 🔗

6 What is a hard insurance market?

- Author: insurancebusinessmag.com

- Published Date: 10/18/2022

- Review: 3.88 (397 vote)

- Summary: · Hard market – In the insurance industry, a hard market is the upswing in a market cycle, when premiums increase and capacity for most types of

- Matching search results: The insurance market has been highly competitive or ‘soft’ for most of the last 15 years. Over this long period, market rates dropped below profitable levels as insurers aggressively competed against each other for their market share, driving …

- Source: 🔗

7 State of the Market 2021 – A Hardening Insurance Market

- Author: midlandinsurance.com.au

- Published Date: 06/20/2022

- Review: 3.64 (520 vote)

- Summary: Alternatively, a hard market is when there is a high demand for insurance, but a lower supply of coverage available. The primary impact on customers is a rise

- Matching search results: The Australian market suffered heavy catastrophe losses in 2020, shaken by bushfires, cyclones, floods and hailstorms which raged across much of Australia’s eastern seaboard and resulted in immense financial costs for the insurance industry. …

- Source: 🔗

8 2022 State of the Insurance Market – News – Tools & Intel | CRC Group

- Author: crcgroup.com

- Published Date: 04/20/2022

- Review: 3.46 (428 vote)

- Summary: Research indicates that the global insurance industry will exceed $7 trillion in premium by mid-. THE HARD MARKET CONTINUES. While more moderate in 2022,

- Matching search results: The insurance broker’s role has evolved in recent years to extend beyond simply brokering transactions to serving as a trusted advisor capable of shaping expectations and educating clients as they navigate the insurance landscape. 2022 will be a …

- Source: 🔗

9 Insurance trends 2022: Navigating a hard market

- Author: beale-law.com

- Published Date: 09/23/2022

- Review: 3.28 (291 vote)

- Summary: · Insurance trends 2022: Navigating a hard market … the latest thoughts of our leading sector specialist partners on the insurance claims

- Matching search results: The insurance broker’s role has evolved in recent years to extend beyond simply brokering transactions to serving as a trusted advisor capable of shaping expectations and educating clients as they navigate the insurance landscape. 2022 will be a …

- Source: 🔗

10 Insurance—hard and soft markets

- Author: lexisnexis.co.uk

- Published Date: 11/24/2021

- Review: 3.07 (389 vote)

- Summary: · The insurance market can be described as hard or soft, reflecting the economy, market conditions and competition. In a hard market, fewer

- Matching search results: The insurance broker’s role has evolved in recent years to extend beyond simply brokering transactions to serving as a trusted advisor capable of shaping expectations and educating clients as they navigate the insurance landscape. 2022 will be a …

- Source: 🔗

11 Hard Market Trend Report: The Insurance Pendulum

- Author: prolink.insure

- Published Date: 12/29/2021

- Review: 2.82 (162 vote)

- Summary: What Does The Hard Market Mean For You? … After a few tough years, the Canadian insurance industry has been operating at a loss across all lines. With billions

- Matching search results: The insurance broker’s role has evolved in recent years to extend beyond simply brokering transactions to serving as a trusted advisor capable of shaping expectations and educating clients as they navigate the insurance landscape. 2022 will be a …

- Source: 🔗

12 Hard Market | Insurance Glossary Definition – IRMI.com

- Author: irmi.com

- Published Date: 02/22/2022

- Review: 2.86 (167 vote)

- Summary: Hard Market — in the insurance industry, the upswing in a market cycle, when premiums increase and capacity for most types of insurance decreases

- Matching search results: The insurance broker’s role has evolved in recent years to extend beyond simply brokering transactions to serving as a trusted advisor capable of shaping expectations and educating clients as they navigate the insurance landscape. 2022 will be a …

- Source: 🔗

13 Hard vs soft: How to navigate the insurance cycle

- Author: qbe.com

- Published Date: 12/01/2021

- Review: 2.69 (134 vote)

- Summary: In a hard market, insurers are firmer with pricing and conservative with risk selection · Experts say the industry is experiencing the hardest market in 50 years

- Matching search results: For example, if you spend a day placing one risk then that may be considered a good day. However, if you spend half a day placing the same business, then that’s a better day. It’s this time investment that is the key difference between a hard and …

- Source: 🔗

14 How the hard market is a time for opportunity – Sovereign Insurance

- Author: sovereigninsurance.ca

- Published Date: 02/05/2022

- Review: 2.52 (125 vote)

- Summary: The hard market is an opportunity to: · Deliver an exceptional experience: Clear communication and timely service are key. · Focus on underwriting excellence: A

- Matching search results: While in a soft market pricing is a primary competitive factor, Francisco Saldias, Property and Casualty Specialist at Sovereign Insurance, says that “when the hard market hits, pricing becomes less relevant and there’s increased focus on risk …

- Source: 🔗

15 What Are Insurance Market Cycles? Soft vs. Hard Markets

- Author: hisnv.com

- Published Date: 07/03/2022

- Review: 2.4 (107 vote)

- Summary: · During a “hard market”, positive financial results become more difficult for insurers. Challenging regulatory changes that negatively impact

- Matching search results: In a soft market, the cost of insurance, also known as premiums, is low due to intense competition between insurance companies. Insurers try to offer potential customers as well as their current customers lower rates than their competitors. On the …

- Source: 🔗

16 The current state of the insurance market

- Author: propertycasualty360.com

- Published Date: 02/04/2022

- Review: 2.37 (120 vote)

- Summary: · Hard markets are characterized by relatively high premiums, fewer options for coverage and a reduced willingness of carriers to compete with one

- Matching search results: In a soft market, the cost of insurance, also known as premiums, is low due to intense competition between insurance companies. Insurers try to offer potential customers as well as their current customers lower rates than their competitors. On the …

- Source: 🔗

17 Latest advice from Sutcliffe & Co

- Author: sutcliffeinsurance.co.uk

- Published Date: 06/18/2022

- Review: 2.36 (102 vote)

- Summary: A hard market makes underwriters cautious about who and what they will insure. So as a policyholder, you need to demonstrate a high standard of risk management

- Matching search results: You may find your business’s insurance facing rate increases as the insurance market becomes more challenging. Why? Insurers are looking to balance their books with either reduced capacity, pulling out of some risk areas, and/or revisiting terms and …

- Source: 🔗

18 The insurance market is hardening: What does that mean for your

- Author: bizjournals.com

- Published Date: 09/15/2022

- Review: 2.2 (191 vote)

- Summary: · A hard insurance market is the upswing in a market cycle when insurance premium rates are escalating, and insurers are disinclined to negotiate

- Matching search results: You may find your business’s insurance facing rate increases as the insurance market becomes more challenging. Why? Insurers are looking to balance their books with either reduced capacity, pulling out of some risk areas, and/or revisiting terms and …

- Source: 🔗

19 A Hard Insurance Market Commands Higher Rates But Fewer Customers

- Author: oneagentsalliance.net

- Published Date: 03/25/2022

- Review: 2.16 (68 vote)

- Summary: A hard insurance market means there’s a high demand for insurance coverage and a reduced supply. Insurance companies use very strict underwriting standards

- Matching search results: You may find your business’s insurance facing rate increases as the insurance market becomes more challenging. Why? Insurers are looking to balance their books with either reduced capacity, pulling out of some risk areas, and/or revisiting terms and …

- Source: 🔗

20 Hard Market vs. Soft Market: The Insurance Industrys Cycle and Why Were Currently in a Hard Market

- Author: psafinancial.com

- Published Date: 05/17/2022

- Review: 2 (129 vote)

- Summary: During a hard market, underwriting gets tougher and more stringent. With each year, underwriters are becoming more sophisticated, looking more closely at losses

- Matching search results: We first saw the effects of the hard marked in the commercial industry. Commercial insurance prices in total rose by six percent during the second quarter of 2012 compared to the same prior year. But we are now seeing a hard market in the personal …

- Source: 🔗

21 2022 P&C Underwriting Profitability Seen Worsening as Inflation

- Author: iii.org

- Published Date: 06/26/2022

- Review: 1.96 (179 vote)

- Summary: · Auto Insurance, Business Insurance, Insurers and the Economy … Underwriting Profitability Seen Worsening as Inflation, Hard Market Persist

- Matching search results: We first saw the effects of the hard marked in the commercial industry. Commercial insurance prices in total rose by six percent during the second quarter of 2012 compared to the same prior year. But we are now seeing a hard market in the personal …

- Source: 🔗

22 What is a soft or hard market in the insurance industry?

- Author: summitcover.ca

- Published Date: 10/10/2022

- Review: 1.81 (65 vote)

- Summary: · A soft insurance market which means rates are flat or decreasing, and insurance coverages are readily available. By contrast, during hard market

- Matching search results: There are several other macroeconomic factors that play a role in insurance market cycles which we did not address, such as interest rates, bond yields, larger natural catastrophes and stock market performance. All these factors play a significant …

- Source: 🔗

23 Is the Insurance Market Hard or Soft?

- Author: thebalancemoney.com

- Published Date: 11/12/2021

- Review: 1.61 (143 vote)

- Summary: · Key Takeaways · A hard insurance market is when there is high demand for insurance coverage and low appetite to insure. · A soft market is when

- Matching search results: There are several other macroeconomic factors that play a role in insurance market cycles which we did not address, such as interest rates, bond yields, larger natural catastrophes and stock market performance. All these factors play a significant …

- Source: 🔗