1 Appraisal Gap: What to Do When Your Appraisal Falls Short

- Author: compmort.com

- Published Date: 01/13/2022

- Review: 4.91 (690 vote)

- Summary: · … gap in a seller’s market used to mean the buyer pays the difference. Compass Mortgage has an alternative appraisal gap coverage option

- Matching search results: In the appraisal gap example mentioned earlier, the loan amount would remain $240,000, and instead of paying an extra $16,000 to cover the gap, the buyer would just need to pay the $60,000 down payment, plus $1,728 for the cost of mortgage …

- Source: 🔗

2 What is an Appraisal Gap Coverage Clause

- Author: maxrealestateexposure.com

- Published Date: 07/17/2022

- Review: 4.63 (524 vote)

- Summary: · The simple explanation of an appraisal gap is the amount you have agreed to pay for the home vs. what the real estate appraiser says it’s worth

- Matching search results: BUYER has waived their appraisal contingency and acknowledges that if their lender’s appraisal does not equal at least the purchase price herein, the BUYER will pay the difference in funds between what the lender is willing to lend and the purchase …

- Source: 🔗

3 What is Appraisal Gap Coverage?

- Author: nfmlending.com

- Published Date: 05/16/2022

- Review: 4.49 (451 vote)

- Summary: · Appraisal price gap coverage is extra cash the buyer offers the seller to minimize that disparity, guaranteeing they’ll pay the sale price

- Matching search results: For example, if a seller agrees to your competitive offer of $410,000 on the home listed at $400,000 but it appraises for $390,000, there will be an appraisal gap of $20,000. To avoid this discrepancy, you could make an offer of $410,000 + $10,000 …

- Source: 🔗

4 Appraisal Gap: What You Should Know

- Author: forbes.com

- Published Date: 04/02/2022

- Review: 4.23 (319 vote)

- Summary: · An appraisal gap is the difference between how much a home was appraised for and how much you agree to pay for it as a potential buyer. Home

- Matching search results: If you’re OK with paying the difference, it will get added to your closing costs. So when you make that payment—including your down payment and other fees from the purchase—you’ll pay the difference from the appraisal gap as well. This can be a …

- Source: 🔗

5 Appraisal gap financing – Local Housing Solutions

- Author: localhousingsolutions.org

- Published Date: 04/11/2022

- Review: 4.15 (583 vote)

- Summary: Appraisal gap policies are designed to contribute to improved housing quality, preserve market-affordable housing, improve community development outcomes, and

- Matching search results: Jacksonville, FL Appraisal Gap Financing – The City of Jacksonville Neighborhoods Department uses Foreclosure Property Registry funds to provide grants of up to $50,000 per property to developers for the acquisition, rehabilitation or new …

- Source: 🔗

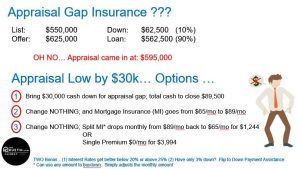

6 Appraisal Gap Insurance -Your Buyers Do NOT Need to Bring More!

- Author: theruethteam.com

- Published Date: 07/05/2022

- Review: 3.97 (330 vote)

- Summary: · Appraisal Gap Insurance?? The buyer is worried about the appraisal coming in low. The listing agent is wanting to see proof of funds

- Matching search results: As a lender, the loan limit is based on a percentage of the lower of the purchase price or appraised value. In this case, I was originally basing a 90% loan on the $625,000 purchase price. Now I am structuring a 95% loan on the $595,000 appraised …

- Source: 🔗

7 What is an appraisal gap, and is it a deal breaker?

- Author: bankrate.com

- Published Date: 09/09/2022

- Review: 3.64 (527 vote)

- Summary: · “An appraisal gap coverage clause is custom wording in the purchase contract that says you will pay the difference between the appraised value

- Matching search results: You can ask the seller to lower the price to match the appraisal price — which they may be motivated to do, depending on their timeline and investment in the property. You can also ask them to split the difference or meet somewhere in the middle, …

- Source: 🔗

8 What to do when the price you offer for a house exceeds the appraised value

- Author: businessinsider.com

- Published Date: 09/24/2021

- Review: 3.41 (223 vote)

- Summary: · An appraisal gap happens when a buyer’s offer exceeds a home’s appraised value. Here’s what to do if that happens

- Matching search results: If you and your agent think the appraised value is inaccurate, you can challenge it with your lender. To do this, you’d write a letter to your lender and include evidence as to why the appraisal is wrong. Perhaps the appraiser missed features of the …

- Source: 🔗

9 What Appraisal Gap Coverage Is—And How It Wins Offers in Red-Hot Markets

- Author: biggerpockets.com

- Published Date: 06/15/2022

- Review: 3.23 (529 vote)

- Summary: · That is called appraisal gap coverage. It is insurance for the seller that the buyer pays an additional amount over the home’s appraised

- Matching search results: A contingency clause in the contract defines a condition or action that must be met for the sales contract to become binding. Both parties—the buyer and the seller—must agree to the terms and sign the sales contract, contingencies included, to …

- Source: 🔗

10 An Appraisal Gap Clause Can Make Your Offer Stand Out, But Know the Risks First

- Author: time.com

- Published Date: 12/28/2021

- Review: 3.01 (524 vote)

- Summary: · An appraisal gap clause is when a homebuyer commits to paying more than the appraised value of a property, if the appraised value is lower than

- Matching search results: The difference between the appraised price and the sale price is important because a lender won’t issue a loan for more than the property is worth or for more than a certain percentage of the home’s value, also known as the loan-to-value ratio …

- Source: 🔗